Winners And Losers Of Q4: Mohawk Industries (NYSE:MHK) Vs The Rest Of The Home Furnishings Stocks

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Mohawk Industries (NYSE:MHK) and the rest of the home furnishings stocks fared in Q4.

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

The 5 home furnishings stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.9% since the latest earnings results.

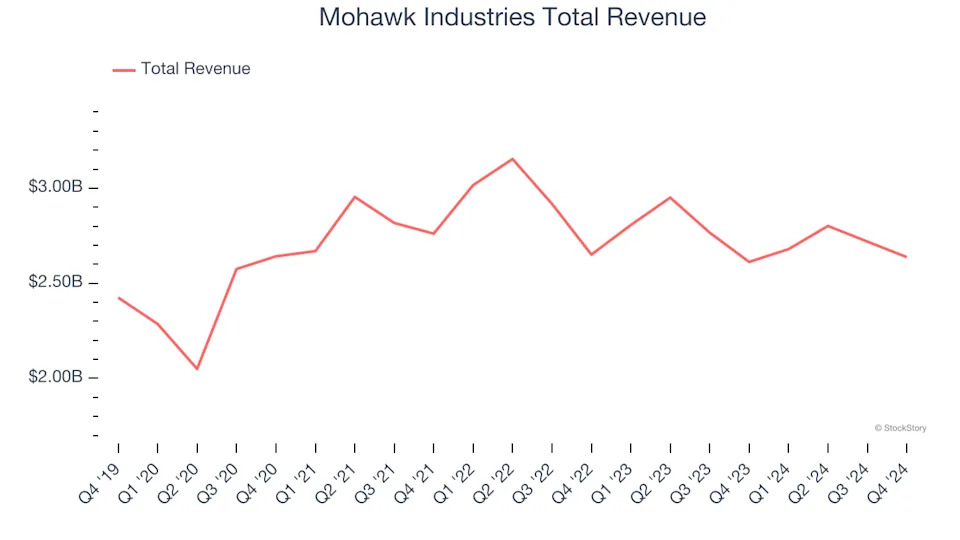

Mohawk Industries (NYSE:MHK)

Established in 1878, Mohawk Industries (NYSE:MHK) is a leading producer of floor-covering products for both residential and commercial applications.

Mohawk Industries reported revenues of $2.64 billion, flat year on year. This print exceeded analysts’ expectations by 4.1%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ organic revenue estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

Commenting on the Company’s fourth quarter and full year, Chairman and CEO Jeff Lorberbaum stated, “Our fourth quarter results exceeded our expectations as sales actions, restructuring initiatives and productivity improvements benefited our performance. Additionally, the negative sales impact from U.S. hurricanes was limited to approximately $10 million. While residential demand remained soft in our markets, our product introductions last year and our marketing initiatives contributed to our sales performance around the globe.

Mohawk Industries pulled off the biggest analyst estimates beat of the whole group. Still, the market seems discontent with the results. The stock is down 10.3% since reporting and currently trades at $115.24.

Is now the time to buy Mohawk Industries? Access our full analysis of the earnings results here, it’s free .

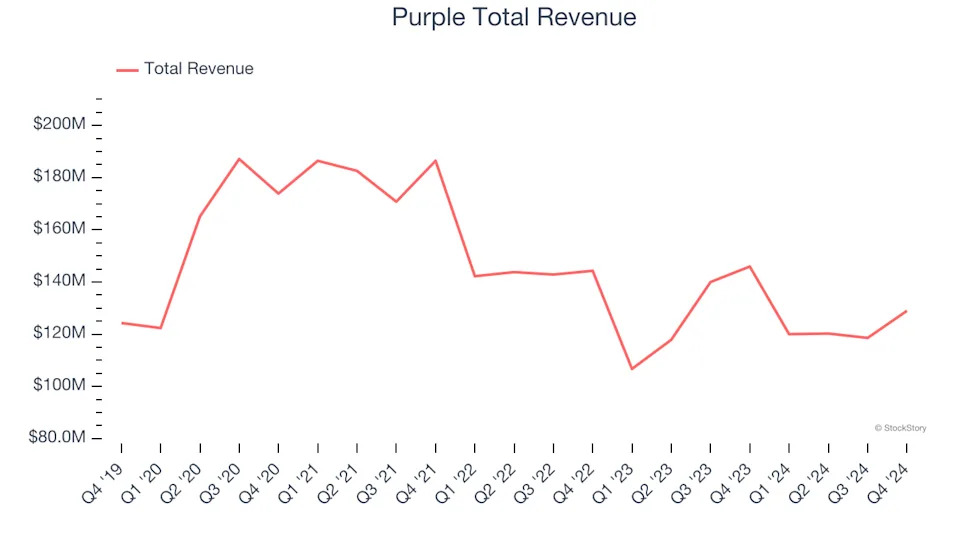

Best Q4: Purple (NASDAQ:PRPL)

Founded by two brothers, Purple (NASDAQ:PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.