Reflecting On Data & Business Process Services Stocks’ Q4 Earnings: CoStar (NASDAQ:CSGP)

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the data & business process services stocks, including CoStar (NASDAQ:CSGP) and its peers.

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

The 11 data & business process services stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

While some data & business process services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.3% since the latest earnings results.

CoStar (NASDAQ:CSGP)

With a research department that makes over 10,000 property updates daily to its 35-year-old database, CoStar Group (NASDAQ:CSGP) provides comprehensive real estate data, analytics, and online marketplaces for commercial and residential properties in the U.S. and U.K.

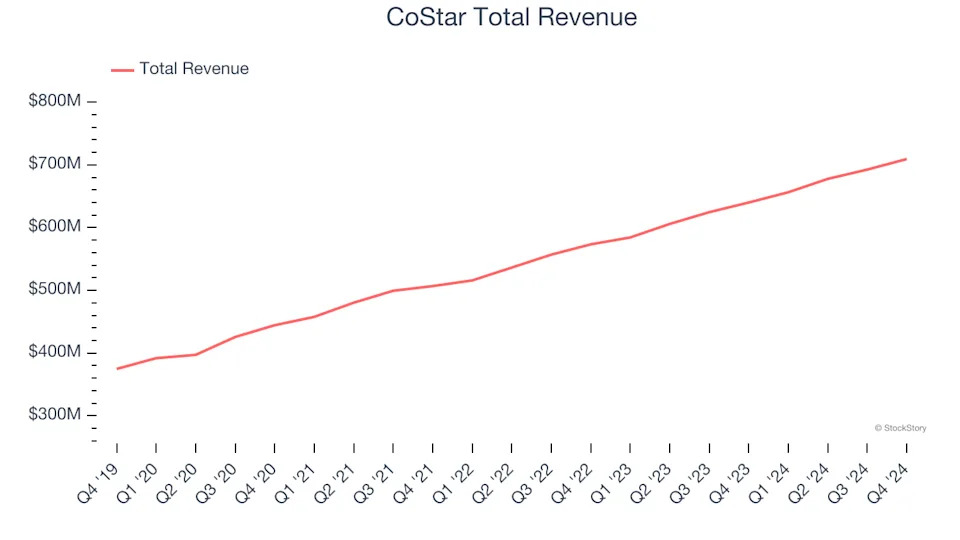

CoStar reported revenues of $709.4 million, up 10.8% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates.

The stock is up 5% since reporting and currently trades at $79.25.

Is now the time to buy CoStar? Access our full analysis of the earnings results here, it’s free .

Best Q4: CSG (NASDAQ:CSGS)

Powering billions of critical customer interactions annually, CSG Systems (NASDAQ:CSGS) provides cloud-based software platforms that help companies manage customer interactions, process payments, and monetize their services.

CSG reported revenues of $316.7 million, up 6.5% year on year, in line with analysts’ expectations. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

CSG delivered the highest full-year guidance raise among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $60.37.