Stocks cap worst quarter in 3 years as investors realize Trump's not in their corner

The trade war is escalating, and as President Donald Trump touts his April 2 tariff deadline as America's "liberation day," once-bullish investors are feeling shellshocked as they navigate the volatility.

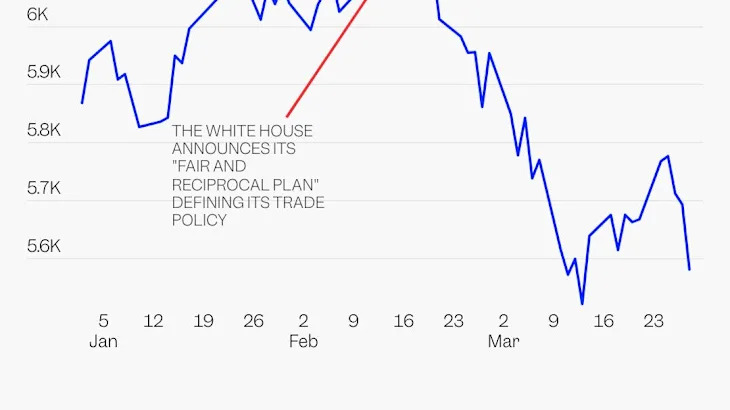

After back-to-back years of double-digit gains, the stock market on Monday wrapped up its worst quarter since 2022, with the S&P 500 and the Nasdaq Composite finishing with losses of 5% and 10%, respectively.

The plunge shows just how much Trump has surprised markets since returning to the White House, and not in a good way. Even as he campaigned on hammering out trade deals that would benefit America, investors are clearly shocked at how far he's gone.

What started out as predictions of Trump versus the Fed amid forecasts for tariffs to fuel a slight rebound in inflation, has become Trump versus the market.

The White House has telegraphed its position stating as much. While Trump was known in his first term for using the stock market as a gauge for his presidency, his team has signaled they don't mind the decline in equity prices for now.

Treasury Secretary Scott Bessent has said the administration isn't worried about the volatility , while Trump insists tariffs will be an economic windfall. Instead, the president appears to be focusing his attention on the 10-year US Treasury yield in order to lower borrowing costs.

Now, forecasters and investors on Wall Street are slashing their expectations for this year.

The AAII's latest Investors Sentiment Survey shows 52% of investors said they felt bearish on the stock market over the next six months, double the historical average of 31%. CNN's Fear and Greed index is at "extreme fear" levels, deepening its descent from a week ago, and plunging from a year ago when it hovered around "extreme greed" territory.

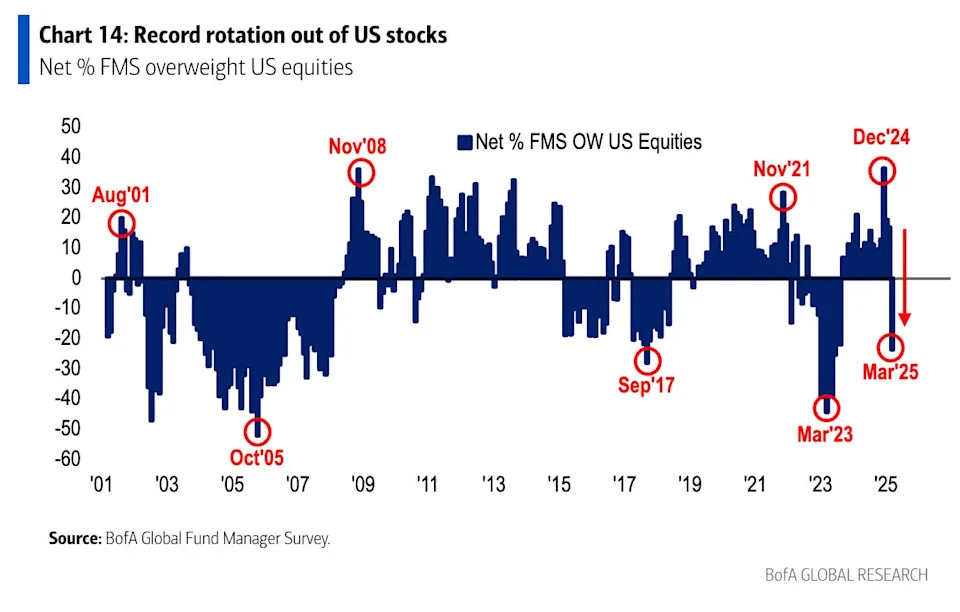

Fund managers also sold stocks at a record pace in in recent weeks, according to a Bank of America survey conducted between March 7 and 13, with investors now positioned 23% underweight the US market, the lowest since last June.

Meanwhile, analysts at the biggest banks are adjusting their outlooks downward.

Goldman Sachs was the first major bank to pull back on its stock forecast, with strategists cutting their target for the S&P 500 to 6,200 from 6,500 in early March.