Q4 Earnings Highlights: Braze (NASDAQ:BRZE) Vs The Rest Of The Sales And Marketing Software Stocks

Let’s dig into the relative performance of Braze (NASDAQ:BRZE) and its peers as we unravel the now-completed Q4 sales and marketing software earnings season.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.4% since the latest earnings results.

Braze (NASDAQ:BRZE)

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ:BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

Braze reported revenues of $160.4 million, up 22.5% year on year. This print exceeded analysts’ expectations by 3%. Overall, it was a strong quarter for the company with accelerating customer growth and EPS guidance for next quarter exceeding analysts’ expectations.

"Fiscal 2025 was a milestone year for Braze that reinforced our position as the leading Customer Engagement platform through robust customer growth and continued advancements in our product, including meaningful new investments in AI and machine learning. We grew revenue 26% while continuing to drive strong operating leverage, ending the year with three straight quarters of non-GAAP net income profitability,” said Bill Magnuson, Cofounder and CEO of Braze.

The stock is down 3.1% since reporting and currently trades at $35.56.

Is now the time to buy Braze? Access our full analysis of the earnings results here, it’s free .

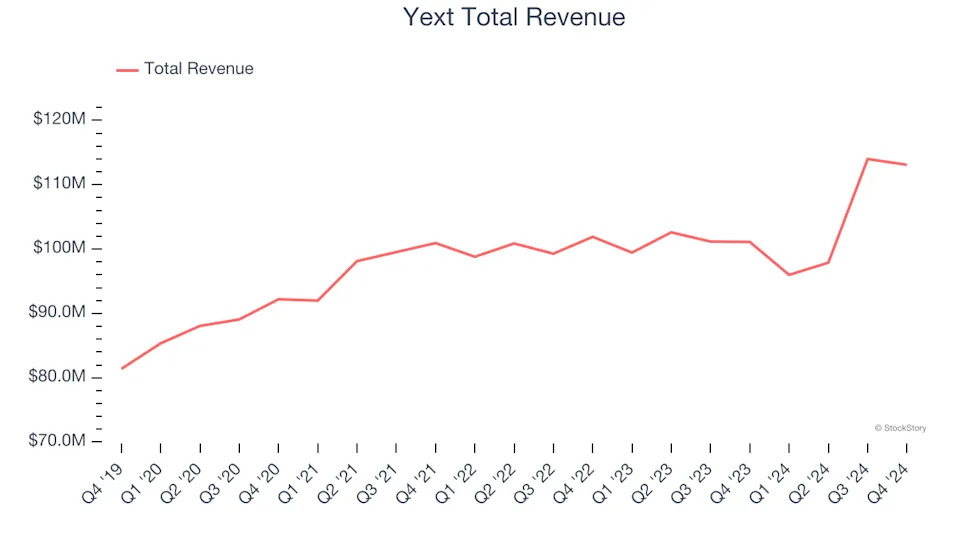

Best Q4: Yext (NYSE:YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $113.1 million, up 11.9% year on year, in line with analysts’ expectations. The business had an exceptional quarter with an impressive beat of analysts’ annual recurring revenue estimates and a solid beat of analysts’ billings estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.1% since reporting. It currently trades at $6.16.