3 Reasons PKG is Risky and 1 Stock to Buy Instead

Although the S&P 500 is down 1.7% over the past six months, Packaging Corporation of America’s stock price has fallen further to $196.44, losing shareholders 8.8% of their capital. This might have investors contemplating their next move.

Is there a buying opportunity in Packaging Corporation of America, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the more favorable entry price, we're swiping left on Packaging Corporation of America for now. Here are three reasons why PKG doesn't excite us and a stock we'd rather own.

Why Do We Think Packaging Corporation of America Will Underperform?

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products as well as displays and package protection.

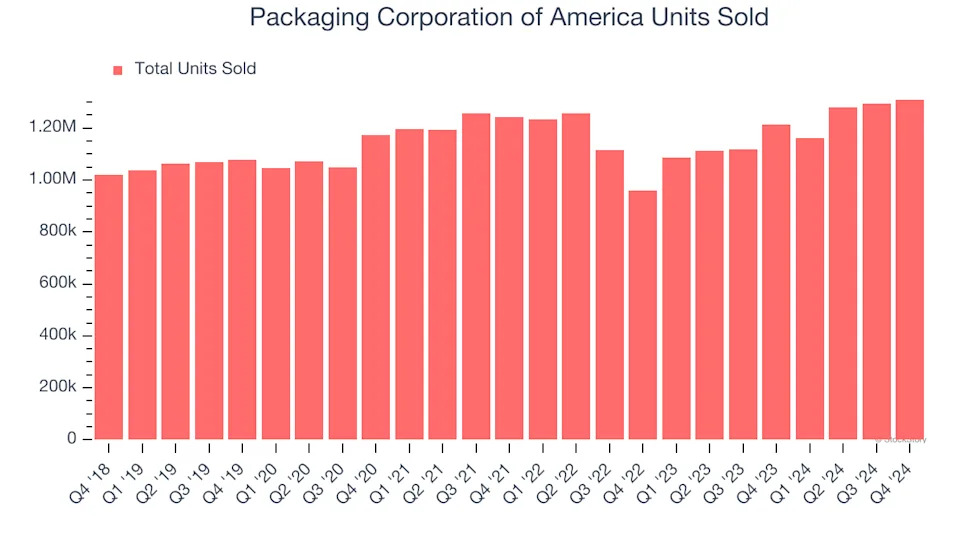

1. Weak Sales Volumes Indicate Waning Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Industrial Packaging company because there’s a ceiling to what customers will pay.

Packaging Corporation of America’s units sold came in at 1.31 million in the latest quarter, and over the last two years, averaged 6.1% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

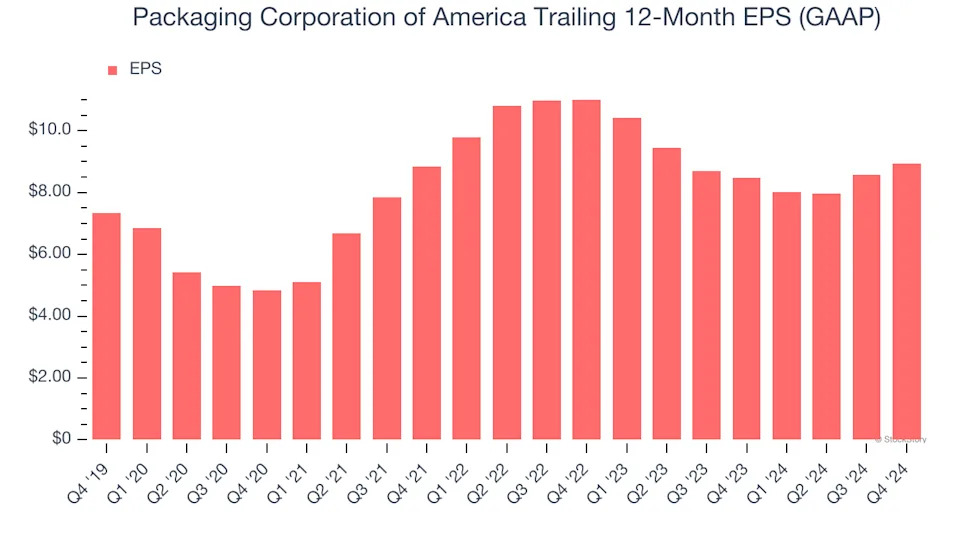

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Packaging Corporation of America’s unimpressive 4% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Packaging Corporation of America’s margin dropped by 3 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Packaging Corporation of America’s free cash flow margin for the trailing 12 months was 6.2%.

Final Judgment

Packaging Corporation of America doesn’t pass our quality test. Following the recent decline, the stock trades at 17.4× forward price-to-earnings (or $196.44 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. Let us point you toward one of our top digital advertising picks .