Q4 Earnings Outperformers: Dover (NYSE:DOV) And The Rest Of The General Industrial Machinery Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at general industrial machinery stocks, starting with Dover (NYSE:DOV).

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 14 general industrial machinery stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 2.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.6% since the latest earnings results.

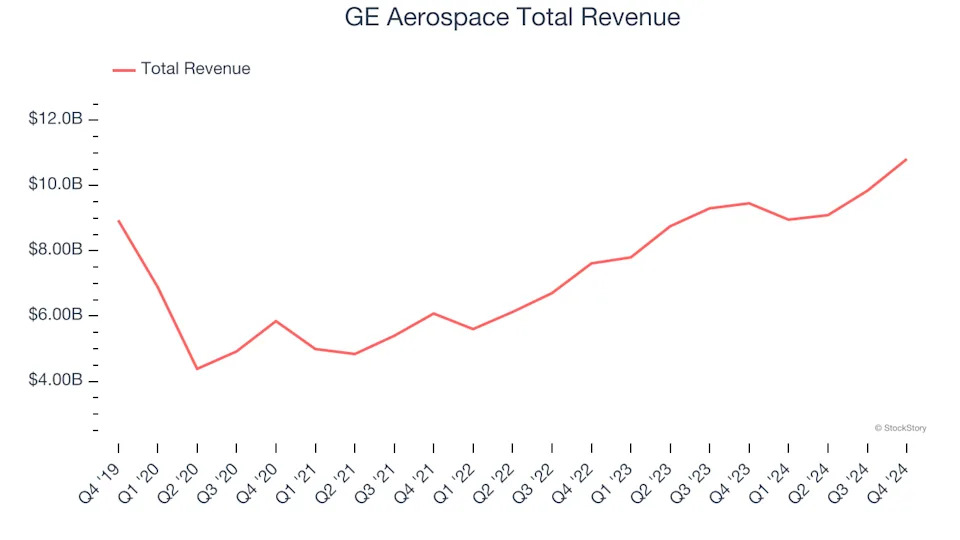

Dover (NYSE:DOV)

A company that manufactured critical equipment for the United States military during World War II, Dover (NYSE:DOV) manufactures engineered components and specialized equipment for numerous industries.

Dover reported revenues of $1.93 billion, up 1.3% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates and a slight miss of analysts’ organic revenue estimates.

Dover's President and Chief Executive Officer, Richard J. Tobin, said, "Dover's fourth quarter results were very encouraging as we move into 2025, with broad-based top line strength across the portfolio and particularly robust performances within the Clean Energy & Fueling and Pumps & Process Solutions segments. Order trends continued their positive trajectory in the quarter with book-to-bill above one, driven by robust bookings in our secular-growth-exposed markets in single-use biopharma components, thermal connectors, and CO2 systems."

The stock is down 11.2% since reporting and currently trades at $175.07.

Read our full report on Dover here, it’s free .

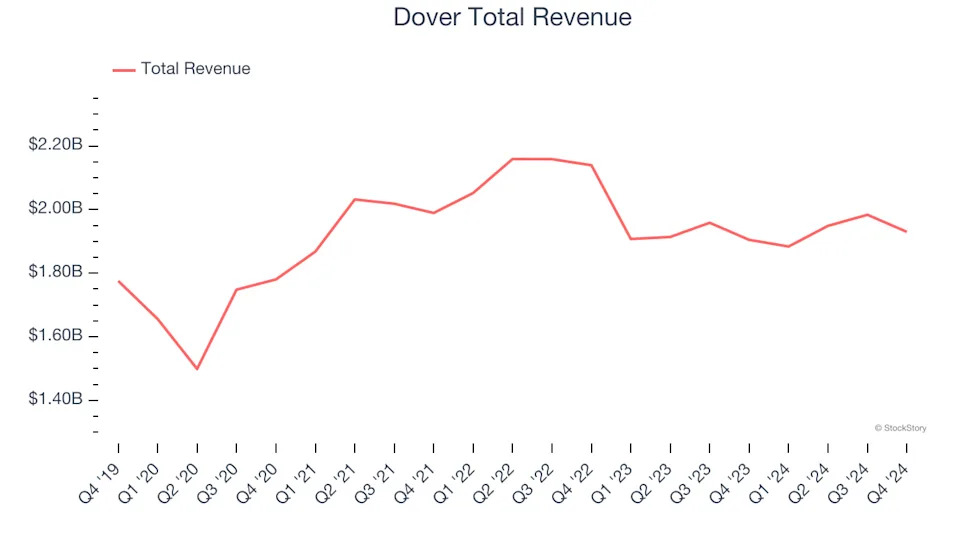

Best Q4: GE Aerospace (NYSE:GE)

One of the original 12 companies on the Dow Jones Industrial Average, General Electric (NYSE:GE) is a multinational conglomerate providing technologies for various sectors including aviation, power, renewable energy, and healthcare.

GE Aerospace reported revenues of $10.81 billion, up 14.3% year on year, outperforming analysts’ expectations by 13.7%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.