Q4 Rundown: ACV Auctions (NYSE:ACVA) Vs Other Online Marketplace Stocks

Looking back on online marketplace stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including ACV Auctions (NYSE:ACVA) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 13 online marketplace stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.4% since the latest earnings results.

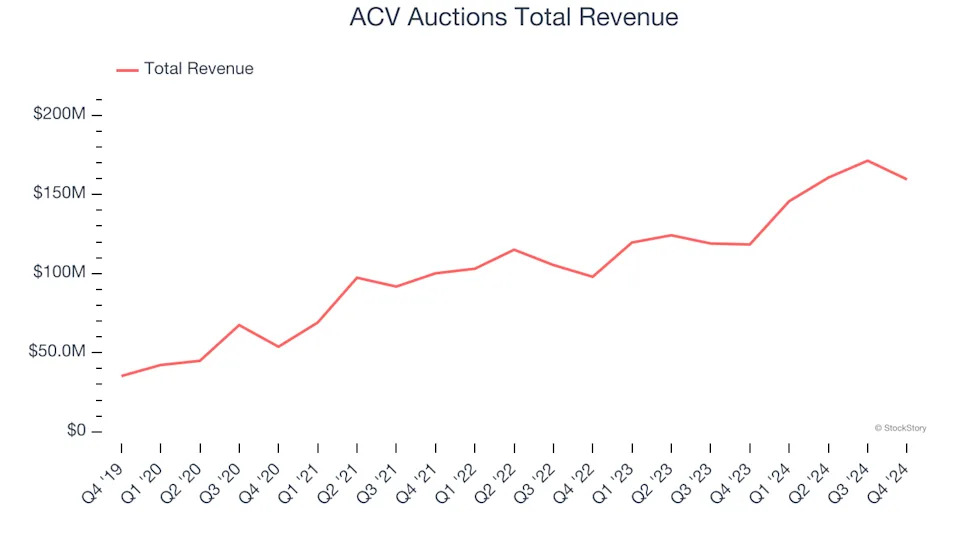

ACV Auctions (NYSE:ACVA)

Founded in 2014, ACV Auctions (NASDAQ:ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $159.5 million, up 34.8% year on year. This print exceeded analysts’ expectations by 2.4%. Despite the top-line beat, it was still a slower quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

“We are very pleased with our fourth quarter results, with revenue and Adjusted EBITDA above the high-end of our guidance range, along with continued margin expansion. ACV's leading market position resulted in additional share gains and strong revenue growth in the quarter. Our expanding suite of dealer solutions gained further market traction and we executed on initiatives to support our commercial wholesale strategy,” said George Chamoun, CEO of ACV.

ACV Auctions delivered the weakest full-year guidance update of the whole group. The company reported 183,497 units sold, up 27.4% year on year. Unsurprisingly, the stock is down 32.4% since reporting and currently trades at $13.93.

Is now the time to buy ACV Auctions? Access our full analysis of the earnings results here, it’s free .

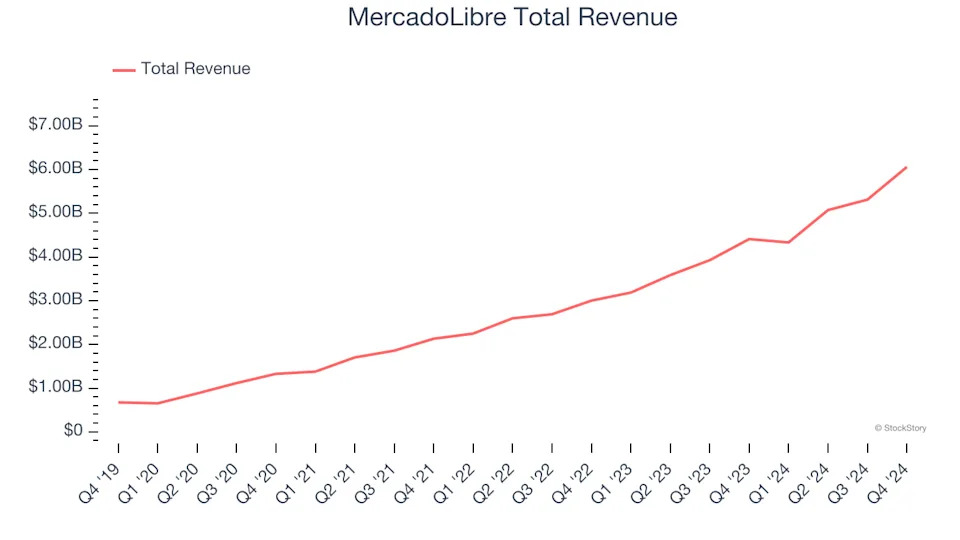

Best Q4: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $6.06 billion, up 37.4% year on year, outperforming analysts’ expectations by 2.8%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ number of unique active users estimates.