Unpacking Q4 Earnings: Airbnb (NASDAQ:ABNB) In The Context Of Other Consumer Internet Stocks

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer internet industry, including Airbnb (NASDAQ:ABNB) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.1% since the latest earnings results.

Airbnb (NASDAQ:ABNB)

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

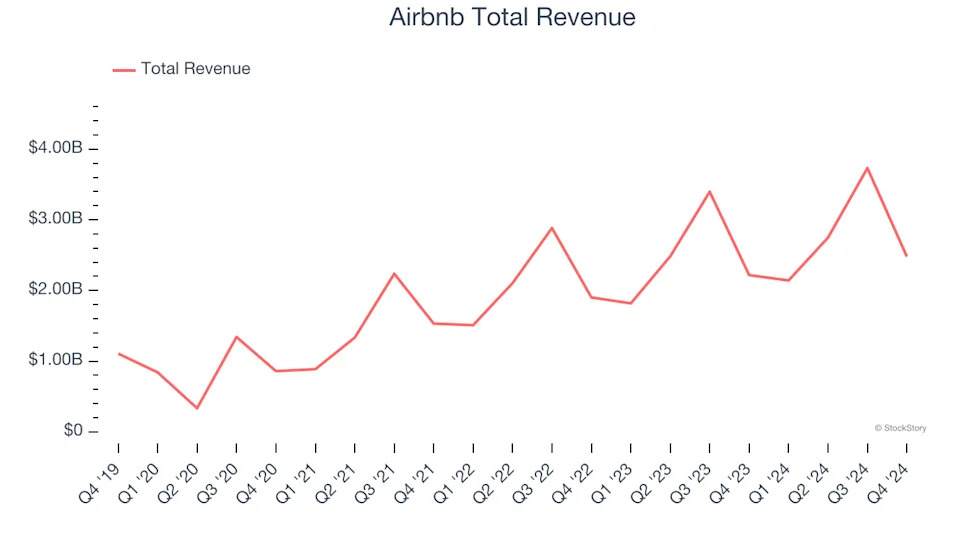

Airbnb reported revenues of $2.48 billion, up 11.8% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of nights and experiences booked estimates.

The stock is down 15% since reporting and currently trades at $119.76.

Read why we think that Airbnb is one of the best consumer internet stocks, our full report is free.

Best Q4: Carvana (NYSE:CVNA)

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

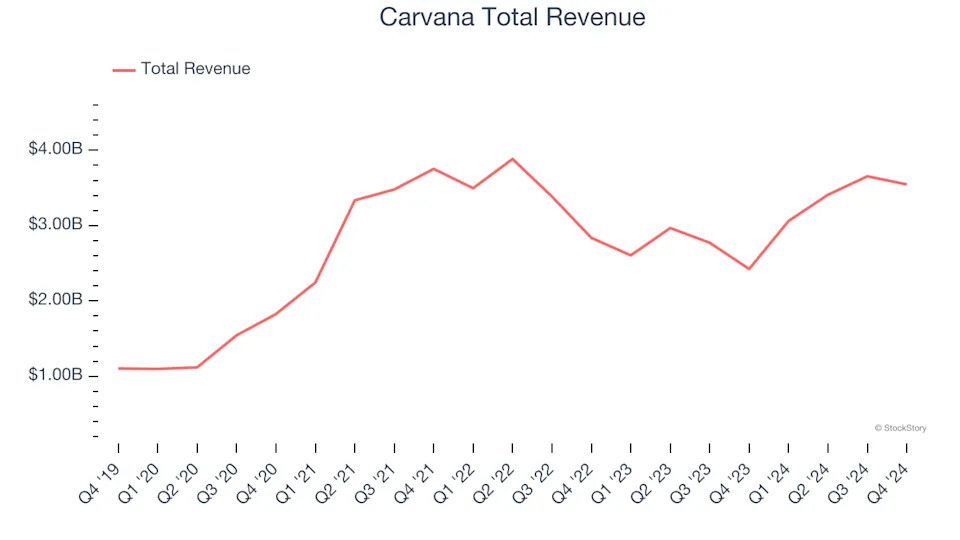

Carvana reported revenues of $3.55 billion, up 46.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 24.8% since reporting. It currently trades at $211.85.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $20.37 million, down 34.5% year on year, falling short of analysts’ expectations by 18.7%. It was a disappointing quarter as it posted a decline in its users.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 110,000 monthly active users, down 19.7% year on year. As expected, the stock is down 11.8% since the results and currently trades at $4.50.