Reflecting On Automation Software Stocks’ Q4 Earnings: Appian (NASDAQ:APPN)

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the automation software industry, including Appian (NASDAQ:APPN) and its peers.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.9% since the latest earnings results.

Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

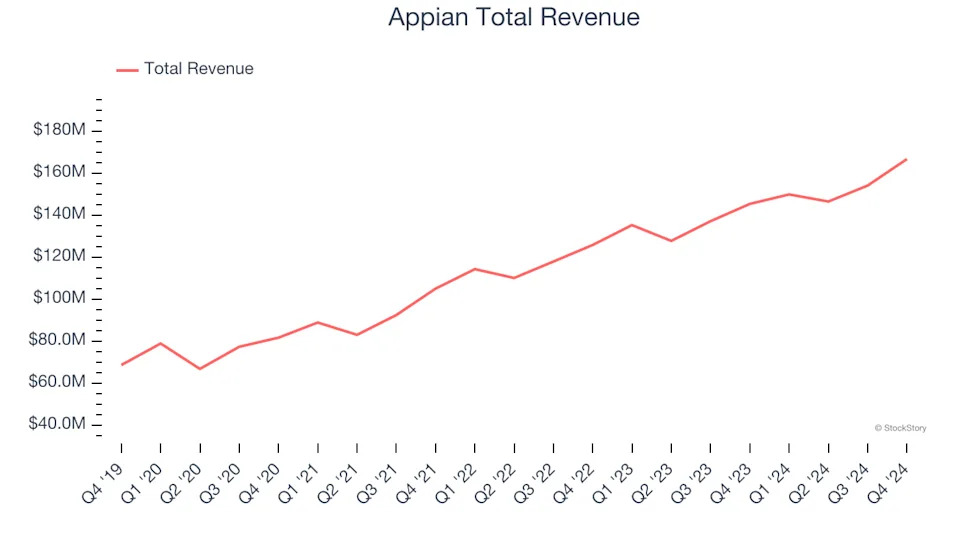

Appian reported revenues of $166.7 million, up 14.7% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ billings estimates.

“In 2024, Appian demonstrated its ability to grow with increasing efficiency. We specialize in creating value with AI, by deploying it in a process. While others bring work to AI, we bring AI to work,” said Matt Calkins, CEO & Founder.

The stock is down 10.9% since reporting and currently trades at $28.60.

Is now the time to buy Appian? Access our full analysis of the earnings results here, it’s free .

Best Q4: SoundHound AI (NASDAQ:SOUN)

Founded in 2005, SoundHound AI (NASDAQ:SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $34.54 million, up 101% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

SoundHound AI achieved the fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 9.9% since reporting. It currently trades at $8.30.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free .