nCino’s (NASDAQ:NCNO) Q4 Earnings Results: Revenue In Line With Expectations But Stock Drops 17.6%

Bank software company nCino (NASDAQ:NCNO) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 14.3% year on year to $141.4 million. On the other hand, next quarter’s revenue guidance of $139.8 million was less impressive, coming in 4% below analysts’ estimates. Its non-GAAP profit of $0.12 per share was 35.1% below analysts’ consensus estimates.

Is now the time to buy nCino? Find out in our full research report .

nCino (NCNO) Q4 CY2024 Highlights:

"We ended the year strong, with meaningful year-over-year subscription revenues and ACV growth, while continuing to realize efficiencies across our operations," said Sean Desmond, Chief Executive Officer at nCino.

Company Overview

Founded in 2011 in North Carolina, nCino (NASDAQ:NCNO) makes cloud-based operating systems for banks and provides that software-as-a-service.

Banking Software

Consumers these days are accustomed to frictionless digital experiences from online shopping to ordering food or hailing a cab. Financial services firms are notoriously risk averse in adopting modern software, often lacking the resources or competency to develop the digital solutions in-house. That drives demand for software as a service platforms that allows banks and other finance institutions to offer the digital services without having to run or maintain them.

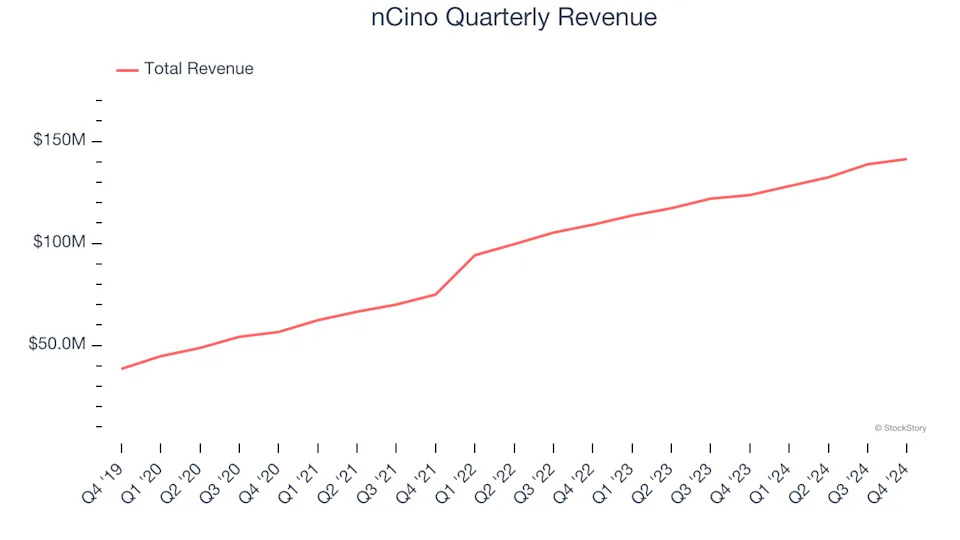

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, nCino’s 25.4% annualized revenue growth over the last three years was solid. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, nCino’s year-on-year revenue growth was 14.3%, and its $141.4 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 9.1% year-on-year increase in sales next quarter.