Travel and Vacation Providers Stocks Q4 Teardown: Delta Air Lines (NYSE:DAL) Vs The Rest

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the travel and vacation providers industry, including Delta Air Lines (NYSE:DAL) and its peers.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 19 travel and vacation providers stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 6.9% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 13.4% since the latest earnings results.

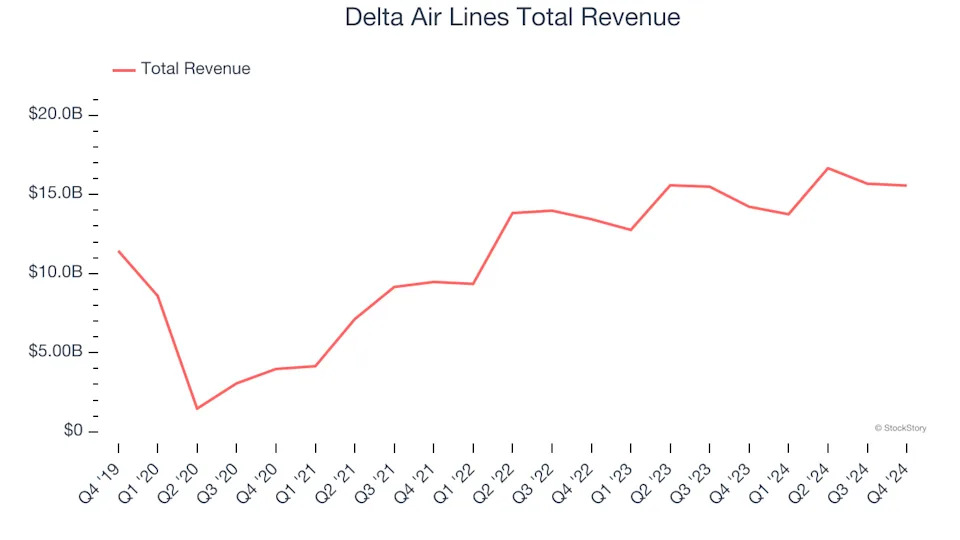

Delta Air Lines (NYSE:DAL)

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE:DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

Delta Air Lines reported revenues of $15.56 billion, up 9.4% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was a strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and revenue guidance for next quarter exceeding analysts’ expectations.

The stock is down 25.1% since reporting and currently trades at $46.01.

Is now the time to buy Delta Air Lines? Access our full analysis of the earnings results here, it’s free .

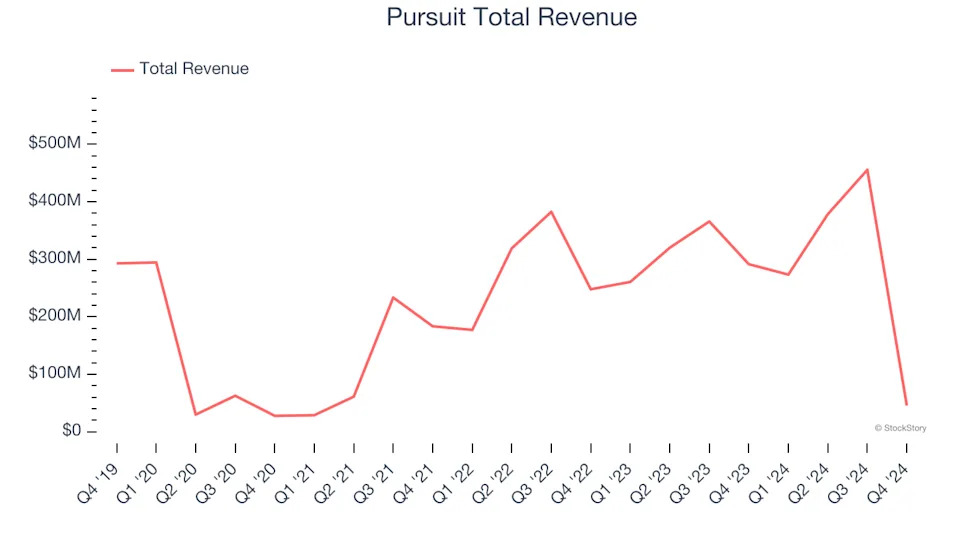

Best Q4: Pursuit (NYSE:PRSU)

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality (NYSE:PRSU) operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

Pursuit reported revenues of $45.8 million, down 84.3% year on year, outperforming analysts’ expectations by 8.8%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The market seems content with the results as the stock is up 1.5% since reporting. It currently trades at $37.70.

Is now the time to buy Pursuit? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Hyatt Hotels (NYSE:H)

Founded in 1957, Hyatt Hotels (NYSE:H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.