Value stock gains need fresh catalyst with earnings a wild card

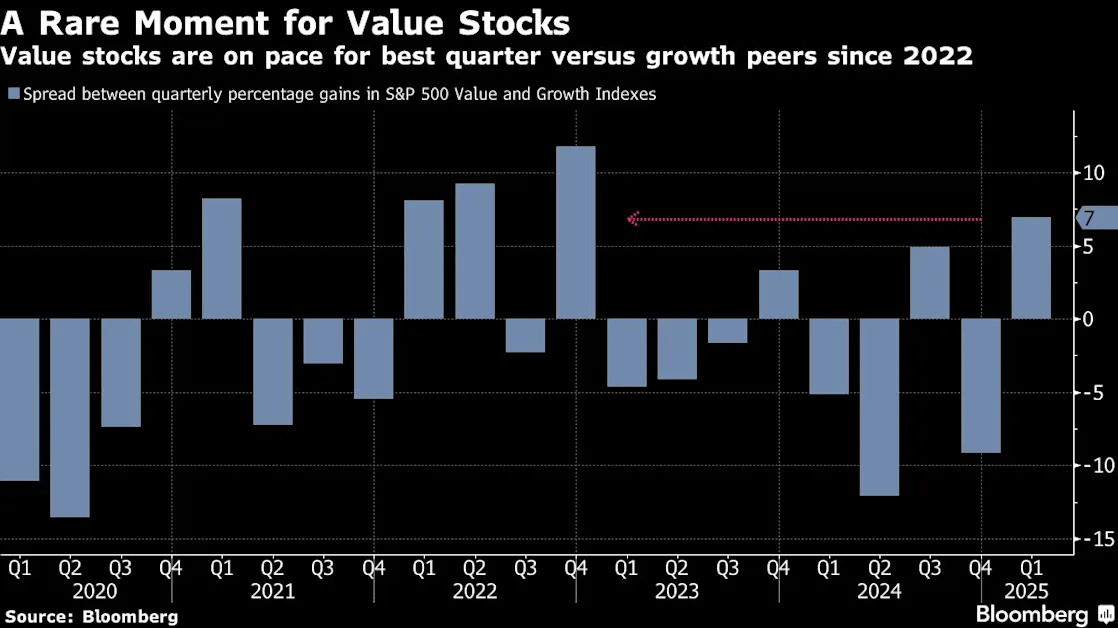

(Bloomberg) — Value stocks are having a rare moment in the face of this year’s equity selloff. The upcoming earnings season will help determine whether the group’s outperformance against the market’s high-flyers can persist.

Most Read from Bloomberg

The S&P 500 Value Index — home to shares of banks, consumer staples, health care and other companies that appear cheap compared to fundamentals — is up 0.4% this year, versus a 6.5% decline for its flashier, growth-focused counterpart. If that holds through the end of March, it would be the value gauge’s best quarterly run against its rival since the market meltdown of 2022.

Worries over historically elevated tech stock valuations, combined with a tariff-induced bout of risk avoidance, have driven the recent rotation from growth into value. While such moves have been short-lived in the past, investors say this time around, profit expectations are so modest that value-oriented companies have a good shot at beating them when earnings season kicks off next month.

“The bar has been set pretty low for value stocks compared to the uncertainty surrounding growth names and their ability to deliver on earnings estimates,” said Dan Morgan, senior portfolio manager at Synovus Trust. “If value can at least match or slightly beat expectations, the runway is clear for them.”

Analysts expect earnings for value companies to fall by 12% in the first quarter from a year earlier, compared to a 20% jump estimated for growth companies, data compiled by Bloomberg Intelligence showed.

Proponents of value stocks argue that their relatively cheap price already reflects the weak earnings expectations for the group. Meanwhile, the market’s hopes for growth companies have risen extensively in the last few years, as excitement over the potential of artificial intelligence fueled massive gains in technology shares.

The S&P 500 Growth Index trades at a forward price-to-earnings multiple of about 25 times, compared to 18 times for the value index. The so-called Magnificent Seven group of tech-focused stocks, which includes massive companies such as Nvidia Corp. ( NVDA ) and Apple Inc. ( AAPL ), trade at an average of 27 times earnings.

Rare Outperformance

The S&P 500 Value Index has outperformed its counterpart on an annual basis only five times in the past two decades. In that span, the value index has risen by 202%, compared to a 600% gain for the growth index.