Spotting Winners: Duolingo (NASDAQ:DUOL) And Consumer Subscription Stocks In Q4

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the consumer subscription stocks, including Duolingo (NASDAQ:DUOL) and its peers.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.4% since the latest earnings results.

Duolingo (NASDAQ:DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

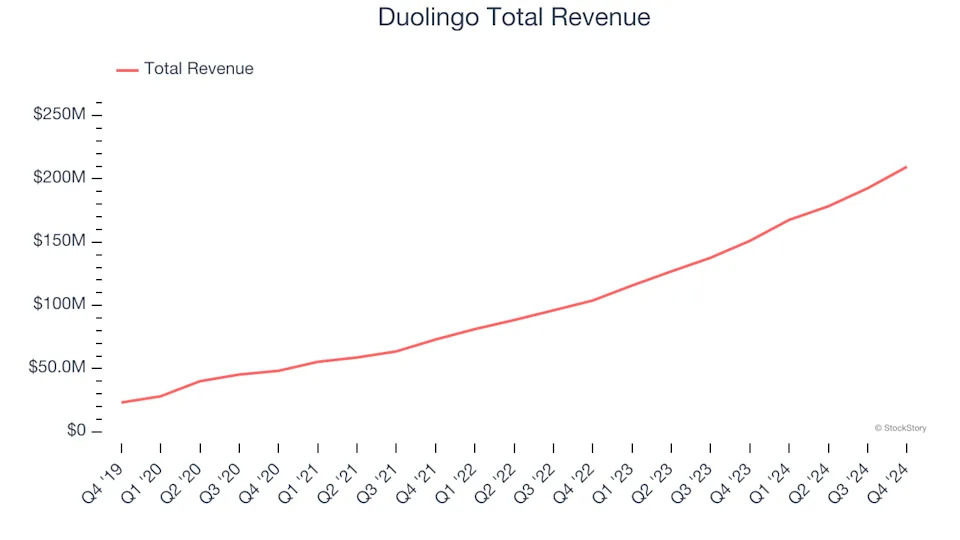

Duolingo reported revenues of $209.6 million, up 38.8% year on year. This print exceeded analysts’ expectations by 2.1%. Despite the top-line beat, it was still a slower quarter for the company with EBITDA guidance for next quarter missing analysts’ expectations.

Duolingo achieved the fastest revenue growth of the whole group. The company reported 116.7 million users, up 32% year on year. Still, the market seems discontent with the results. The stock is down 8.3% since reporting and currently trades at $332.69.

Is now the time to buy Duolingo? Access our full analysis of the earnings results here, it’s free .

Best Q4: Udemy (NASDAQ:UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ:UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

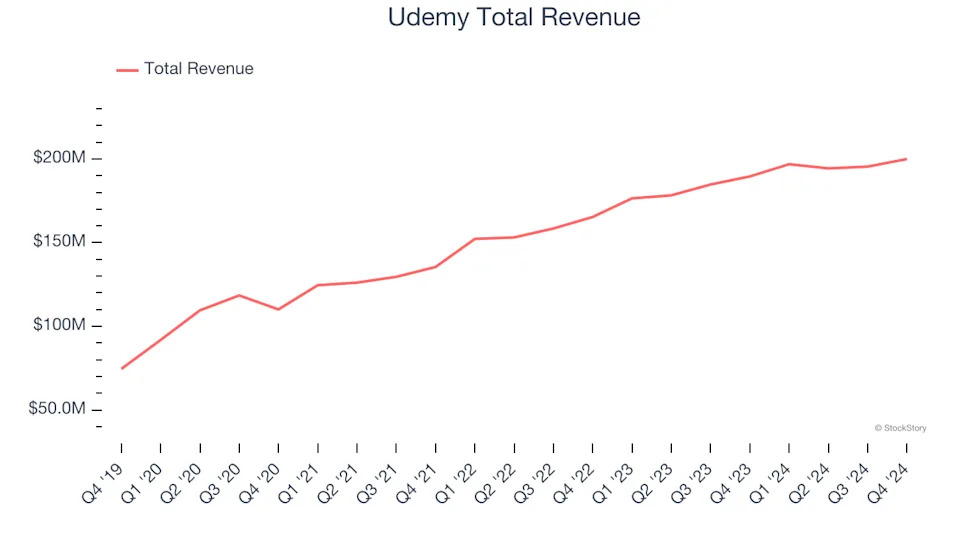

Udemy reported revenues of $199.9 million, up 5.5% year on year, outperforming analysts’ expectations by 2.7%. The business had a strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 8.3% since reporting. It currently trades at $8.47.

Is now the time to buy Udemy? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Match Group (NASDAQ:MTCH)

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ:MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.