Q4 Rundown: Allegion (NYSE:ALLE) Vs Other Electrical Systems Stocks

Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Allegion (NYSE:ALLE) and its peers.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 13 electrical systems stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 6.1% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 14.6% since the latest earnings results.

Allegion (NYSE:ALLE)

Allegion plc (NYSE:ALLE) is a provider of security products and solutions that keep people and assets safe and secure in various environments.

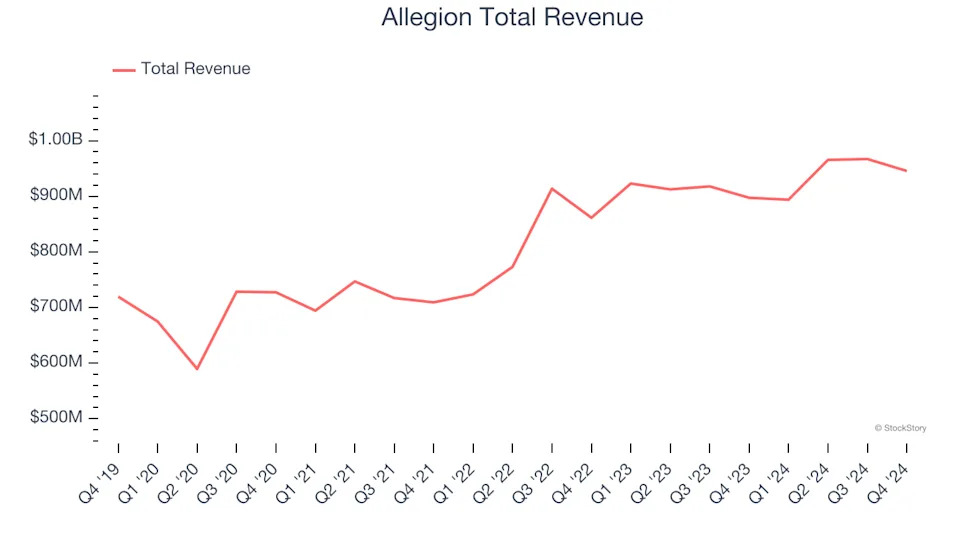

Allegion reported revenues of $945.6 million, up 5.4% year on year. This print exceeded analysts’ expectations by 0.8%. Despite the top-line beat, it was still a mixed quarter for the company with a decent beat of analysts’ EPS estimates but a significant miss of analysts’ EBITDA estimates.

“Allegion delivered a record year in 2024 – a year marked by consistent, strong execution, solid margin expansion and balanced capital deployment,” said Allegion President and CEO John H. Stone.

The stock is down 1.8% since reporting and currently trades at $131.01.

Read our full report on Allegion here, it’s free .

Best Q4: LSI (NASDAQ:LYTS)

Enhancing commercial environments, LSI (NASDAQ:LYTS) provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $147.7 million, up 35.5% year on year, outperforming analysts’ expectations by 14.3%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

LSI pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 11.2% since reporting. It currently trades at $17.58.

Is now the time to buy LSI? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Methode Electronics (NYSE:MEI)

Founded in 1946, Methode Electronics (NYSE:MEI) is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).