3 Reasons ADUS is Risky and 1 Stock to Buy Instead

Addus HomeCare has gotten torched over the last six months - since September 2024, its stock price has dropped 26.9% to $95.71 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Addus HomeCare, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Even though the stock has become cheaper, we're swiping left on Addus HomeCare for now. Here are three reasons why you should be careful with ADUS and a stock we'd rather own.

Why Is Addus HomeCare Not Exciting?

Serving approximately 66,000 clients across 22 states with a focus on "dual eligible" Medicare and Medicaid beneficiaries, Addus HomeCare (NASDAQ:ADUS) provides in-home personal care, hospice, and home health services to elderly, chronically ill, and disabled individuals.

1. Weak Sales Volumes Indicate Waning Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Senior Health, Home Health & Hospice company because there’s a ceiling to what customers will pay.

Addus HomeCare’s average billable patients came in at 50,923 in the latest quarter, and over the last two years, averaged 4.8% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.15 billion in revenue over the past 12 months, Addus HomeCare is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

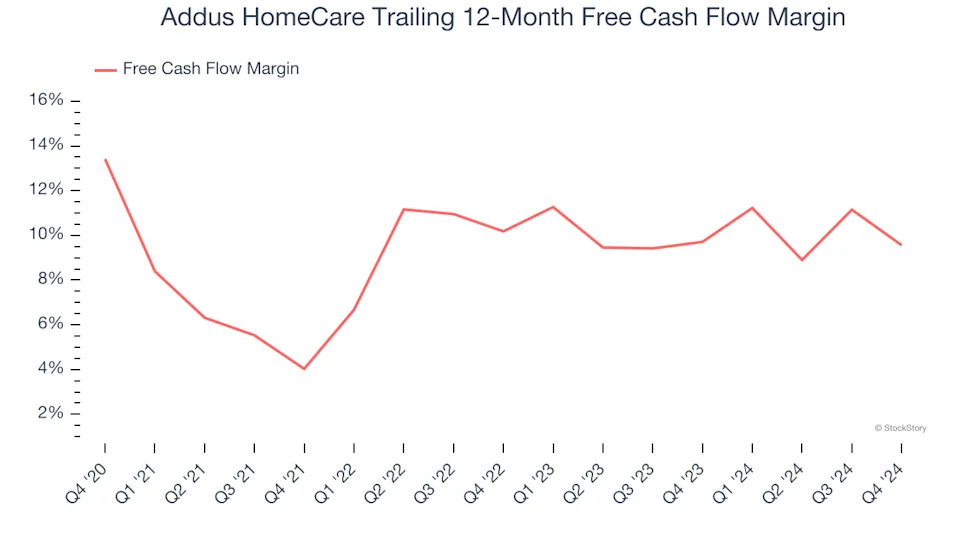

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Addus HomeCare’s margin dropped by 3.9 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Addus HomeCare’s free cash flow margin for the trailing 12 months was 9.6%.