Junk Bonds Win Over Investors Seeking Calm From Market Storm

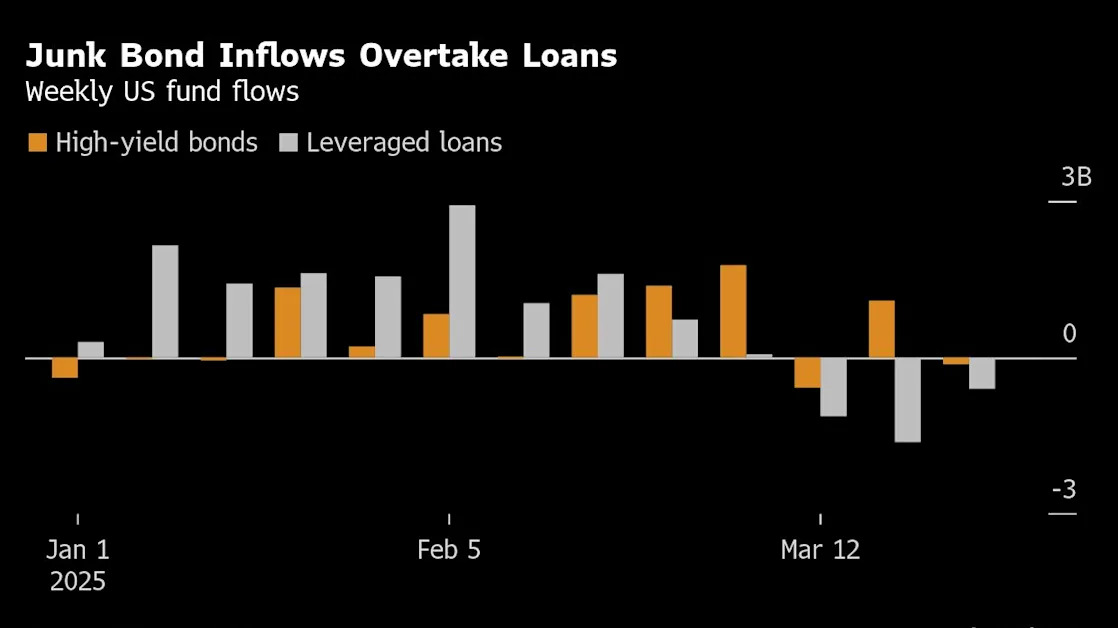

(Bloomberg) -- Junk bonds don’t seem quite so junky anymore. US investors are piling into an asset class that has grown a little safer in recent years, and in recent weeks has drawn investors seeking a safe harbor from market turbulence.

Most Read from Bloomberg

Last year, about 51% of the US high-yield index was in the higher-rated BB category, compared to a long-term average of 40%, according to JPMorgan Chase & Co. analysts led by Nelson Jantzen. A popular trade right now is selling leveraged loans and buying better-rated junk bonds, said Benjamin Burton, the global head of leveraged finance syndicate at Barclays Plc.

As tariffs from the White House threaten to damage some companies’ balance sheets, leveraged finance investors are searching for debt tied to relatively stable companies that can absorb the potential impact from a trade war. They’re finding that in the high-yield bond market, which has picked up former investment-grade names while losing some of its riskiest members to the nascent private credit sector.

Optimism about multiple Federal Reserve interest-rate cuts this year has raised the appeal of bonds, which offer fixed-rate returns. Loans are priced with a floating rate, meaning investors receive smaller interest payments as borrowing costs fall.

“Floating-rate has done what it needed to do,” said Nick Losey, a portfolio manager at Barrow Hanley Global Investors, referring to leveraged loans. “Now investors want more fixed-rate and the higher average credit quality in high-yield bonds.”

The US junk bond market has grown 5.6% since the end of 2023 as investors increasingly swap loans for bonds, according to the JPMorgan analysts. Recent BB-rated bond sales such as a $1 billion offering from Sunoco LP and a $1.75 billion deal from XPLR Infrastructure Operating Partners LP were upsized to meet strong demand.

In contrast, a handful of lower-rated loan deals were pulled in recent weeks, including a $1.21 billion loan for WR Grace and a $790 million deal for Pursuit Aerospace. On Tuesday, Bausch Health Cos. shifted the mix of its $7.4 billion debt offering, putting even more into bonds than loans.

An evolving market

The high-yield market is also benefiting from an influx of “fallen angels,” or companies that have been downgraded from investment-grade to junk. As of last month, the volume of corporate debt falling to high-yield from investment-grade was the highest since 2020, Goldman Sachs Group Inc. analysts led by Lotfi Karoui wrote in a February note, adding that the downgrades reflect company-specific issues, rather than a sign of a “macro shock.”