Education Services Stocks Q4 Highlights: Perdoceo Education (NASDAQ:PRDO)

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the education services stocks, including Perdoceo Education (NASDAQ:PRDO) and its peers.

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

The 8 education services stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 3.7% while next quarter’s revenue guidance was in line.

While some education services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.4% since the latest earnings results.

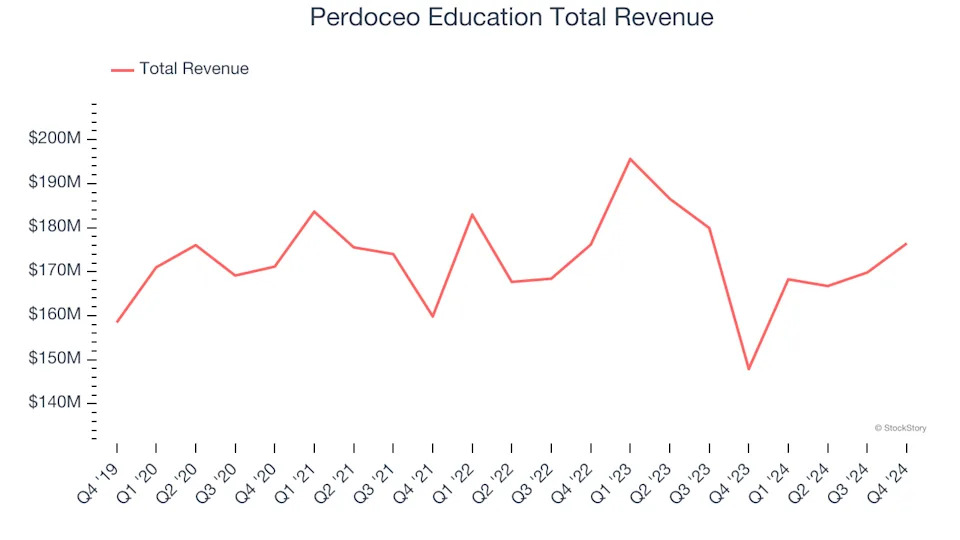

Perdoceo Education (NASDAQ:PRDO)

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ:PRDO) is an educational services company that specializes in postsecondary education.

Perdoceo Education reported revenues of $176.4 million, up 19.3% year on year. This print exceeded analysts’ expectations by 10.2%. Overall, it was a strong quarter for the company with EPS guidance for next quarter topping analysts’ expectations and full-year EPS guidance exceeding consensus estimates.

Perdoceo Education scored the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 12% since reporting and currently trades at $25.36.

Is now the time to buy Perdoceo Education? Access our full analysis of the earnings results here, it’s free .

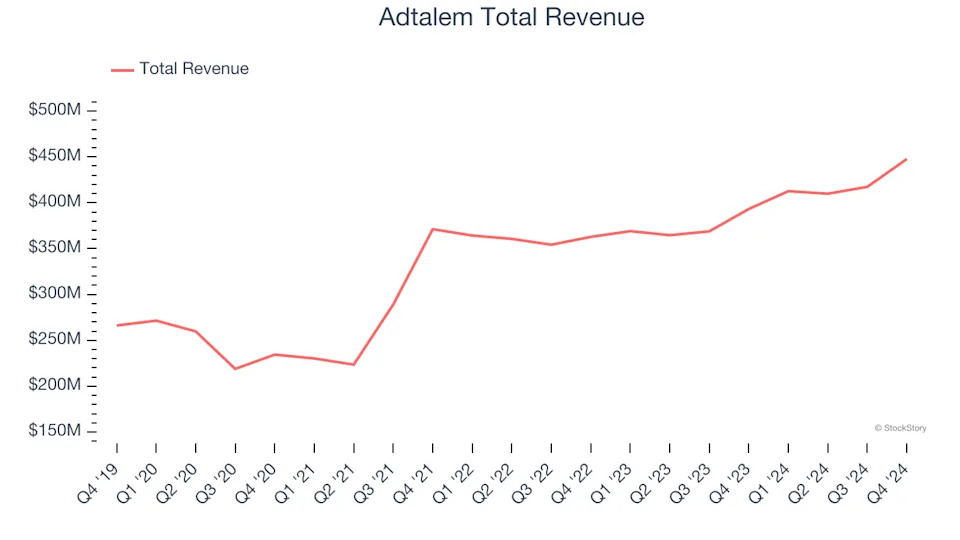

Best Q4: Adtalem (NYSE:ATGE)

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE:ATGE) is a global provider of workforce solutions and educational services.

Adtalem reported revenues of $447.7 million, up 13.9% year on year, outperforming analysts’ expectations by 4.7%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.