Unpacking Q4 Earnings: The Honest Company (NASDAQ:HNST) In The Context Of Other Personal Care Stocks

Let’s dig into the relative performance of The Honest Company (NASDAQ:HNST) and its peers as we unravel the now-completed Q4 personal care earnings season.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.7% while next quarter’s revenue guidance was 7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.9% since the latest earnings results.

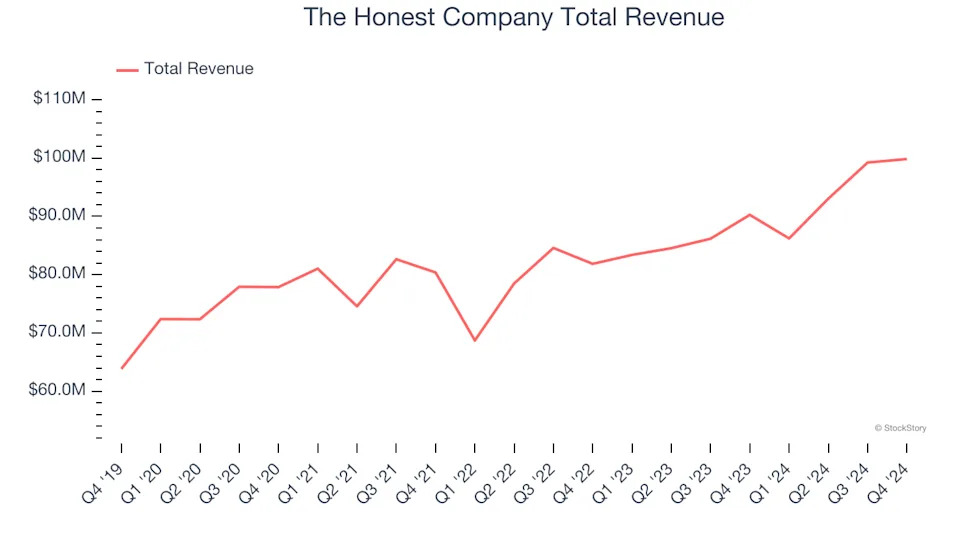

The Honest Company (NASDAQ:HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $99.84 million, up 10.6% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

“Our Q4 and full year 2024 financial results demonstrate that our strategy, which focuses on the disciplined execution of our Transformation Pillars of Brand Maximization, Margin Enhancement and Operating Discipline, is working. In 2024, we achieved record results ahead of our outlook with revenue growth of 10% and first full year positive adjusted EBITDA as a public company. We also achieved gross margin of 38%, an expansion of 900 basis points compared to last year,” said Chief Executive Officer, Carla Vernón.

The stock is down 10.3% since reporting and currently trades at $5.10.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it’s free .

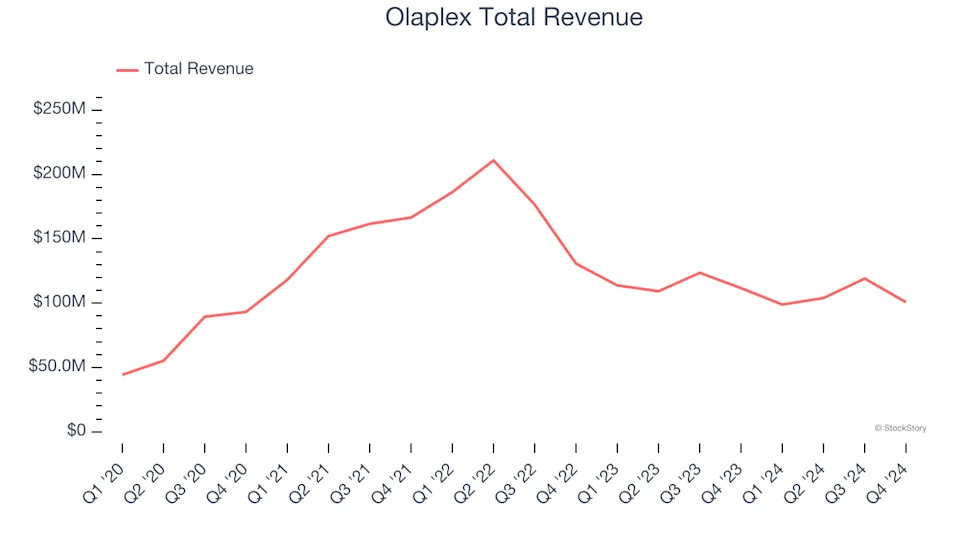

Best Q4: Olaplex (NASDAQ:OLPX)

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ:OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Olaplex reported revenues of $100.7 million, down 9.8% year on year, outperforming analysts’ expectations by 14.4%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.