Leisure Products Stocks Q4 Teardown: Latham (NASDAQ:SWIM) Vs The Rest

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the leisure products industry, including Latham (NASDAQ:SWIM) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 13 leisure products stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 1.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12% since the latest earnings results.

Latham (NASDAQ:SWIM)

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

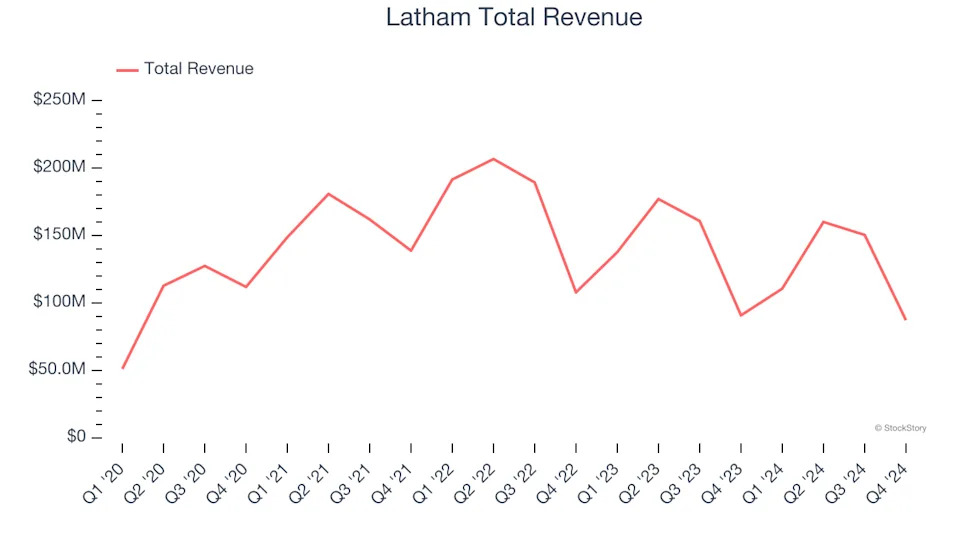

Latham reported revenues of $87.27 million, down 4% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income estimates and full-year revenue guidance exceeding analysts’ expectations.

Commenting on the results, Scott Rajeski, President and CEO, said, “This was a year of substantial achievement for Latham Group. Our in-ground pool sales continued to outperform the U.S. in-ground pool market, we succeeded in expanding margins despite lower utilization, and we made investments that have positioned the Company for sales growth and increased profitability in 2025 and beyond.

Latham achieved the highest full-year guidance raise of the whole group. The stock is up 24% since reporting and currently trades at $6.77.

Is now the time to buy Latham? Access our full analysis of the earnings results here, it’s free .

Best Q4: Malibu Boats (NASDAQ:MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

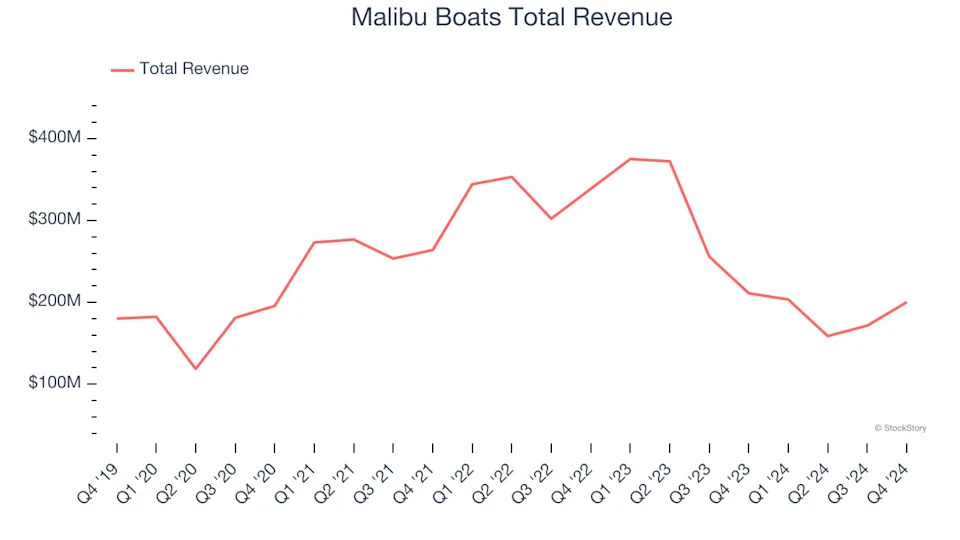

Malibu Boats reported revenues of $200.3 million, down 5.1% year on year, outperforming analysts’ expectations by 4.8%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 23.1% since reporting. It currently trades at $29.54.