3 Reasons to Avoid FUBO and 1 Stock to Buy Instead

fuboTV has been on fire lately. In the past six months alone, the company’s stock price has rocketed 135%, reaching $3.34 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy fuboTV, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why FUBO doesn't excite us and a stock we'd rather own.

Why Is fuboTV Not Exciting?

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

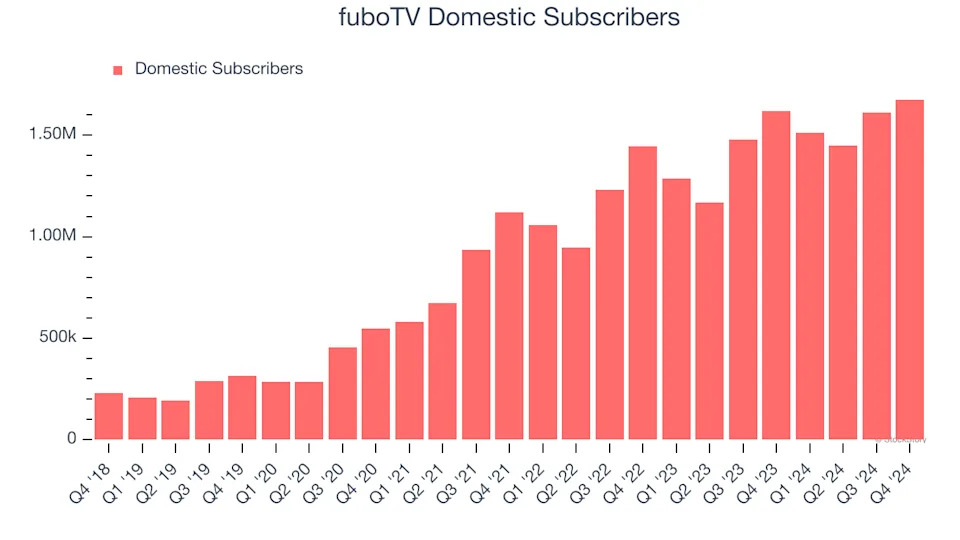

1. Weak Growth in Domestic Subscribers Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like fuboTV, our preferred volume metric is domestic subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

fuboTV’s domestic subscribers came in at 1.68 million in the latest quarter, and over the last two years, averaged 16.4% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

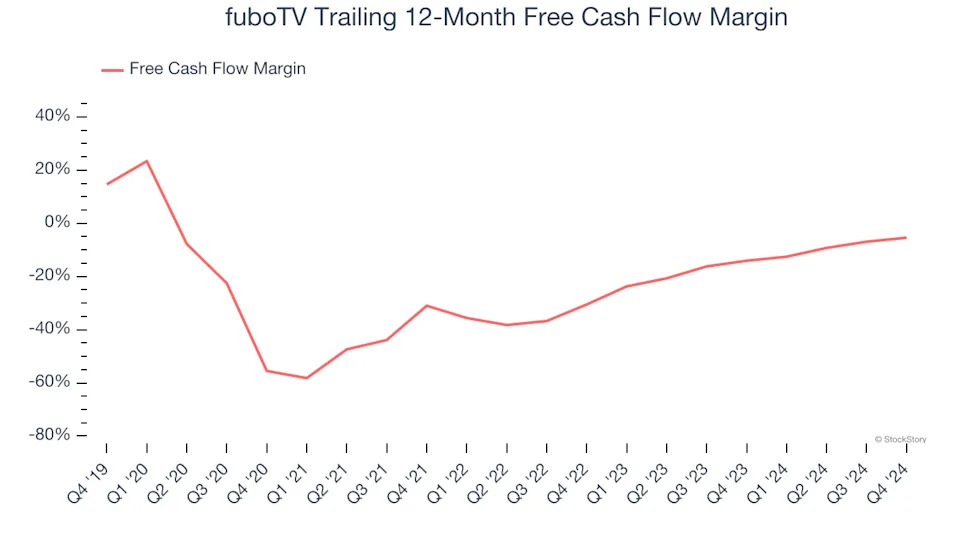

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While fuboTV posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, fuboTV’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.4%, meaning it lit $9.36 of cash on fire for every $100 in revenue.

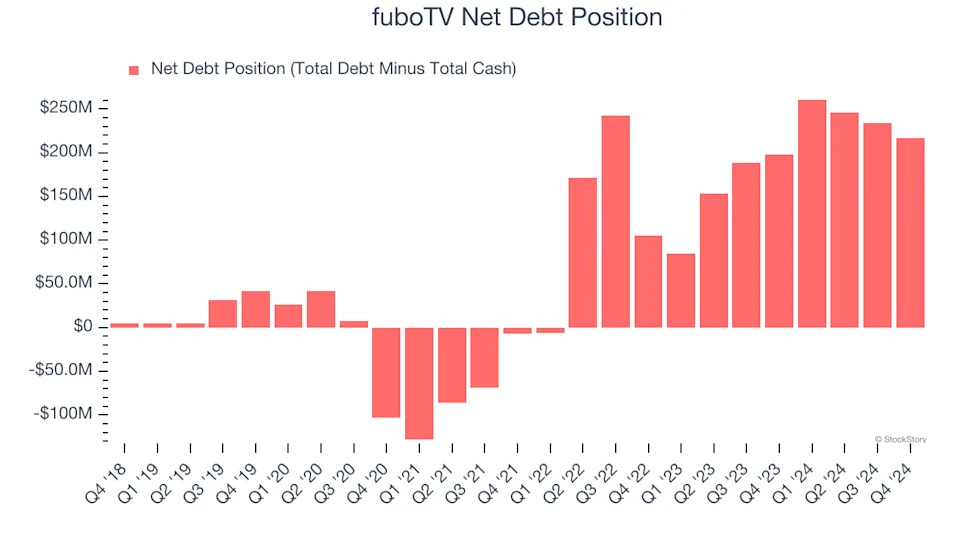

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

fuboTV burned through $87.55 million of cash over the last year, and its $378.4 million of debt exceeds the $161.4 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.