Beverages, Alcohol, and Tobacco Stocks Q4 Recap: Benchmarking Tilray (NASDAQ:TLRY)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Tilray (NASDAQ:TLRY) and the best and worst performers in the beverages, alcohol, and tobacco industry.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 15 beverages, alcohol, and tobacco stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 0.6% below.

While some beverages, alcohol, and tobacco stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.2% since the latest earnings results.

Tilray (NASDAQ:TLRY)

Founded in 2013, Tilray Brands (NASDAQ:TLRY) engages in cannabis research, cultivation, and distribution, offering a range of medical and recreational cannabis products, hemp-based foods, and alcoholic beverages.

Tilray reported revenues of $211 million, up 8.9% year on year. This print fell short of analysts’ expectations by 3.6%. Overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

Irwin D. Simon, Chairman and Chief Executive Officer of Tilray Brands, stated, "In our fiscal second quarter, Tilray achieved strong results while making significant progress on our strategic plan. Our dedication to operational excellence has improved Gross Margins, Gross Profit, and overall profitability across our business segments, positioning us favorably for future success."

Tilray scored the highest full-year guidance raise but had the weakest performance against analyst estimates of the whole group. Still, the market seems discontent with the results. The stock is down 13% since reporting and currently trades at $0.68.

Read our full report on Tilray here, it’s free .

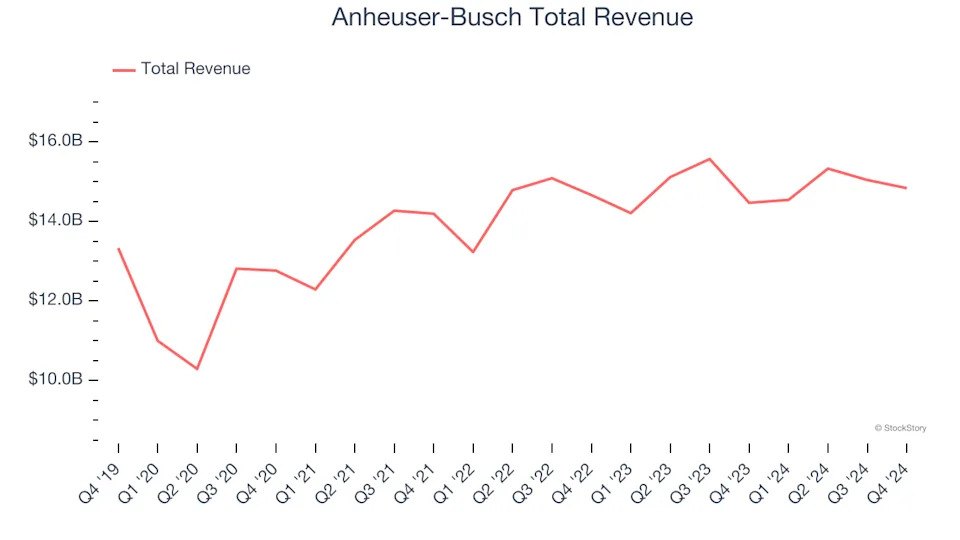

Best Q4: Anheuser-Busch (NYSE:BUD)

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.