Q4 Earnings Recap: Lindsay (NYSE:LNN) Tops Agricultural Machinery Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at agricultural machinery stocks, starting with Lindsay (NYSE:LNN).

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

The 6 agricultural machinery stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 6.7% while next quarter’s revenue guidance was 1.9% above.

While some agricultural machinery stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.1% since the latest earnings results.

Best Q4: Lindsay (NYSE:LNN)

A pioneer in the field of center pivot and lateral move irrigation, Lindsay (NYSE:LNN) provides a variety of proprietary water management and road infrastructure products and services.

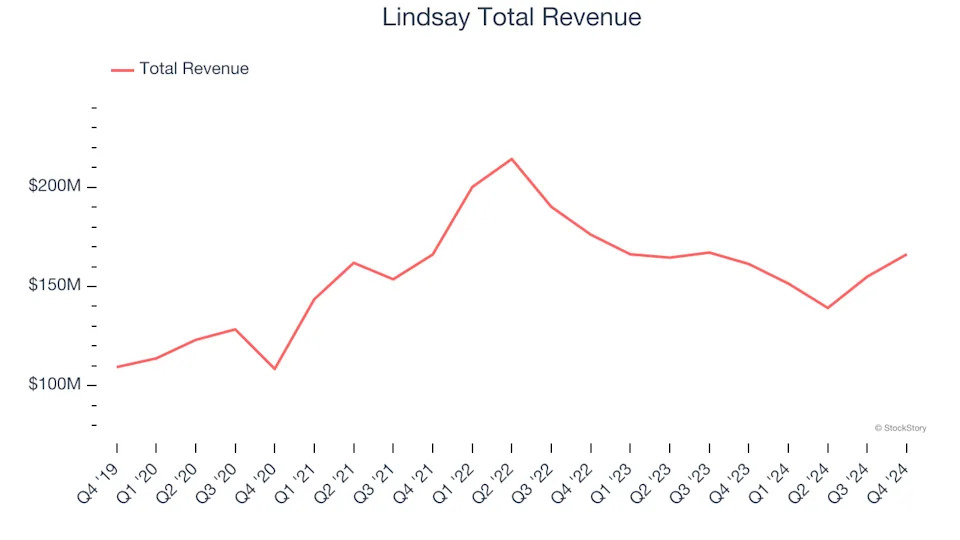

Lindsay reported revenues of $166.3 million, up 3.1% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

“Our first quarter results demonstrate the resilience of our business, as we were able to deliver revenue growth and expansion to net earnings, despite the ongoing cyclical challenges of the mature irrigation markets. While agricultural market conditions in North America and Brazil remain challenged as lower commodity prices negatively impact grower profitability, our international irrigation business drove revenue growth in the segment, supported by additional volumes from our large project in the MENA region,” said Randy Wood, President and Chief Executive Officer.

Lindsay scored the biggest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 8.7% since reporting and currently trades at $127.64.

Is now the time to buy Lindsay? Access our full analysis of the earnings results here, it’s free .

Titan International (NYSE:TWI)

Acquiring Goodyear’s farm tire business in 2005, Titan (NSYE:TWI) is a manufacturer and supplier of wheels, tires, and undercarriages used in off-highway vehicles such as construction vehicles.