Renewable Energy Stocks Q4 Highlights: TPI Composites (NASDAQ:TPIC)

Looking back on renewable energy stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including TPI Composites (NASDAQ:TPIC) and its peers.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 17 renewable energy stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 4.6% while next quarter’s revenue guidance was 0.6% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.4% since the latest earnings results.

TPI Composites (NASDAQ:TPIC)

Founded in 1968, TPI Composites (NASDAQ:TPIC) manufactures composite wind turbine blades and provides related precision molding and assembly systems.

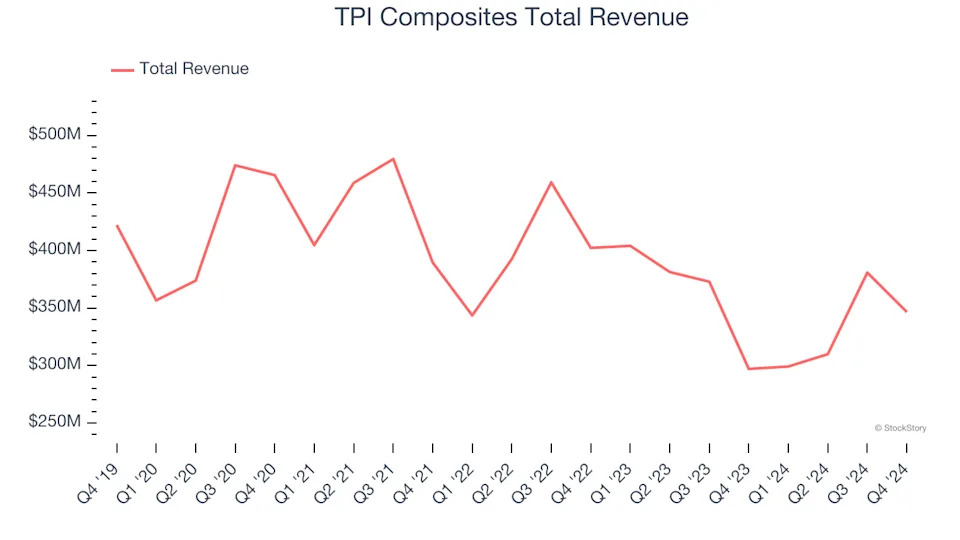

TPI Composites reported revenues of $346.5 million, up 16.7% year on year. This print fell short of analysts’ expectations by 5%. Overall, it was a disappointing quarter for the company with full-year revenue guidance missing analysts’ expectations.

“We delivered solid results in 2024 despite a challenging macroeconomic backdrop for the global wind industry. In 2024, we made the strategic decisions to transition lines to next-generation blades and restructure our portfolio by divesting the Automotive business, shutting down one of our Mexico facilities and rationalizing our workforce in Türkiye to reflect anticipated demand,” said Bill Siwek, President and CEO of TPI Composites.

The stock is down 39.8% since reporting and currently trades at $0.87.

Read our full report on TPI Composites here, it’s free .

Best Q4: Bloom Energy (NYSE:BE)

Working in stealth mode for eight years, Bloom Energy (NYSE:BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Bloom Energy reported revenues of $572.4 million, up 60.4% year on year, outperforming analysts’ expectations by 12.8%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Bloom Energy scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $22.85.