Q4 Rundown: European Wax Center (NASDAQ:EWCZ) Vs Other Leisure Facilities Stocks

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the leisure facilities industry, including European Wax Center (NASDAQ:EWCZ) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 1.6% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.6% since the latest earnings results.

European Wax Center (NASDAQ:EWCZ)

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $49.74 million, down 11.7% year on year. This print fell short of analysts’ expectations by 5%. Overall, it was a slower quarter for the company with full-year revenue guidance missing analysts’ expectations.

Chris Morris, Chairman and CEO of European Wax Center, Inc. stated, “We ended fiscal 2024 on a solid note, delivering fourth quarter results in line with our expectations thanks to the loyalty of our core guests and strong semiannual Wax Pass promotional period. In my first nine weeks as CEO, I have immersed myself in the business by engaging with our key stakeholders. We have a unique and powerful business model underpinned by talented associates and passionate franchisees who continue to voice their commitment to our long-term growth potential. As a result, I am even more optimistic about the future for European Wax Center.”

European Wax Center delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 16.8% since reporting and currently trades at $4.26.

Read our full report on European Wax Center here, it’s free .

Best Q4: Live Nation (NYSE:LYV)

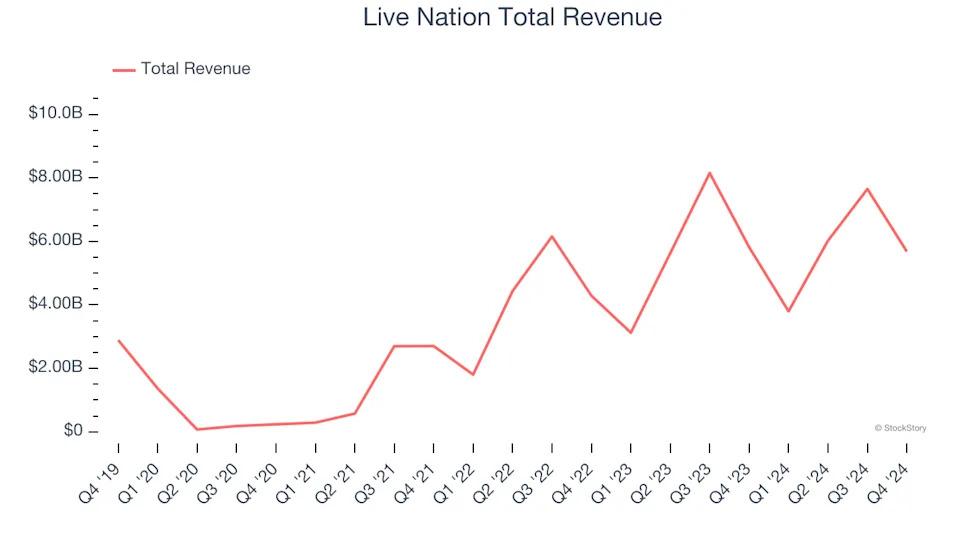

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE:LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $5.68 billion, down 2.4% year on year, outperforming analysts’ expectations by 1.4%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.