Chinese Funds Plan to Mop Up Stocks If US Tariffs Roil Markets

(Bloomberg) -- Any pullback in Chinese stocks from Donald Trump’s April 2 tariffs would be a buying opportunity, according to some of the nation’s most experienced money managers.

Most Read from Bloomberg

The levies would probably be less destructive than feared, while China’s AI breakthrough and a business-friendly policy pivot are seen as game changers, five private fund managers said in separate interviews. They include investors with around two decades of experience at Shenzhen Zhengyuan Investment Co. and Granford (Beijing) Capital Management Co.

Their stance reflects how a fear of missing out on a China turnaround has become a counter-weight to concerns over an expanding trade war. It also reinforces a growing narrative that Chinese markets may become an alternative investment ground as investors reassess US exceptionalism.

“If this does lead to some pull back, we’re adding,” Zhuang Jiapeng, a fund manager at Shenzhen JM Capital, said last week. “What we’ve seen over the past years is that US tariffs and sanctions can only do so little. If you don’t increase now, you’ll be looking at bidding for the same shares at much higher prices later.”

The Hang Seng China Enterprises Index is among the world’s best performers after rallying 21% this year through Monday, thanks to optimism over the nation’s tech competence. Onshore equity benchmarks, which have a higher mix of financials and consumption stocks, are flat for the period. It’s surprising resilience given that China has been a key target of Trump’s tariff volleys.

While the targeted nations and sectors remain unclear for Trump’s April 2 announcement, he said on Monday that auto tariffs are coming while flagging potential exemption for some trading partners. Any further action on China would come on top of the 20% blanket levy slapped across its products earlier this month.

Read: Trump Plans His Tariff ‘Liberation Day’ With More Targeted Push

For private funds, tariff headlines are just noise in what they hope will be a sustainable bull run. The Hang Seng China gauge slipped only 0.6% as the 20% tariffs came into effect on March 4, and rose more than 3% in each of the following two sessions.

The funds, which cater to investors who allocate at least 1 million yuan ($137,850) into a product, tend to be more nimble in positioning as they are free from the restrictions around concentration that mutual funds face. While their asset sizes are usually smaller than that of mutual funds, their flexibility allowed some to post huge outperformances in the past.

“There’s confidence that we’ll be shock-proof, or at least shocks will be easy to recover from,” said Hua Tong, a fund manager at Shenzhen Zhengyuan. “If companies you hold have manufacturing capacities with an edge against peers, there’s no need to fear a day or two of rattled sentiment.” The firm’s flagship fund has gained more than 2,000% since its mid-2016 inception.

2018 Vs 2025

For long-time China watchers, the economy is now better prepared to withstand higher tariffs than in 2018, when Trump’s trade war pushed stocks into a bear market.

Back then, China was on a drive to reign in surging corporate debt just as the economy was cooling and trade tensions were heating up. This time around, President Xi Jinping is on a mission to boost consumption while the nation’s exports are less reliant on the US and earnings from the biggest tech firms point to a recovery.

“Domestics policies will kick in for sure to buffer the impact of tariffs on April 2,” said Fang Lei, a fund manager at Beijing Starrock Investment Management Co. “We have shifted positioning toward domestic consumption.”

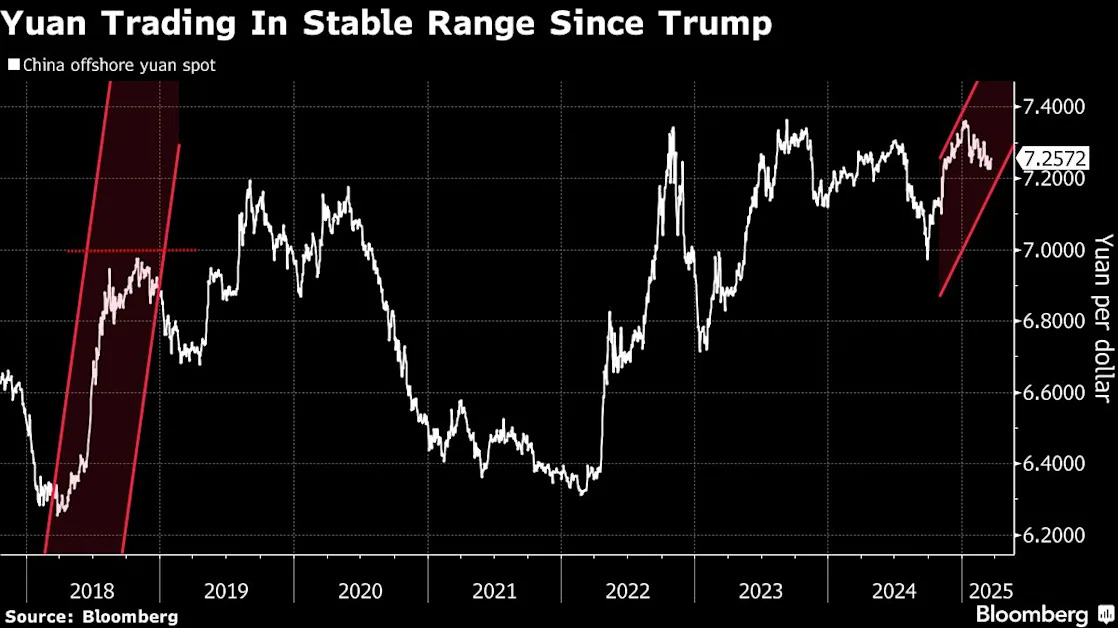

Moves in the currency also suggest that traders are not fixated on tariffs. The offshore yuan weakened more than 5% against the dollar in 2018 when Trump accelerated his trade war. By comparison, China’s currency has strengthened about 1% since the start of 2025.

Yet even if stocks weather further tariffs, it won’t be easy for the rally to get another leg up. There are signs that the euphoria may be cooling. Morgan Stanley said onshore investor sentiment has dropped with lower trading volumes, and expects to see some volatility in the earnings season.

Read: Chinese Stocks in Hong Kong Cap Worst Two-Day Drop Since October

Notwithstanding short-term uncertainties, there are signs of a clear consensus forming — especially among onshore investors — that a market that has underperformed for years has turned around. It’s also comforting to investors that there’s an array of buyers to put a floor under a potential stock rout. That includes not only the sovereign wealth fund, but mutual funds and insurance firms which have been given investment targets by the government.

“Some of our funds have lowered exposure to companies that are more export focused early in the year, but we are still upbeat in the global story for Chinese companies in the longer term,” said Ding Wenjie, strategist for global capital investment at China Asset Management Co., one of the nation’s biggest mutual fund managers. “Any dips could present an opportunity to accumulate.”

(Adds latest comments from Trump in the sixth paragraph)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.