Spotting Winners: Donaldson (NYSE:DCI) And Gas and Liquid Handling Stocks In Q4

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Donaldson (NYSE:DCI) and the best and worst performers in the gas and liquid handling industry.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 gas and liquid handling stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.8% since the latest earnings results.

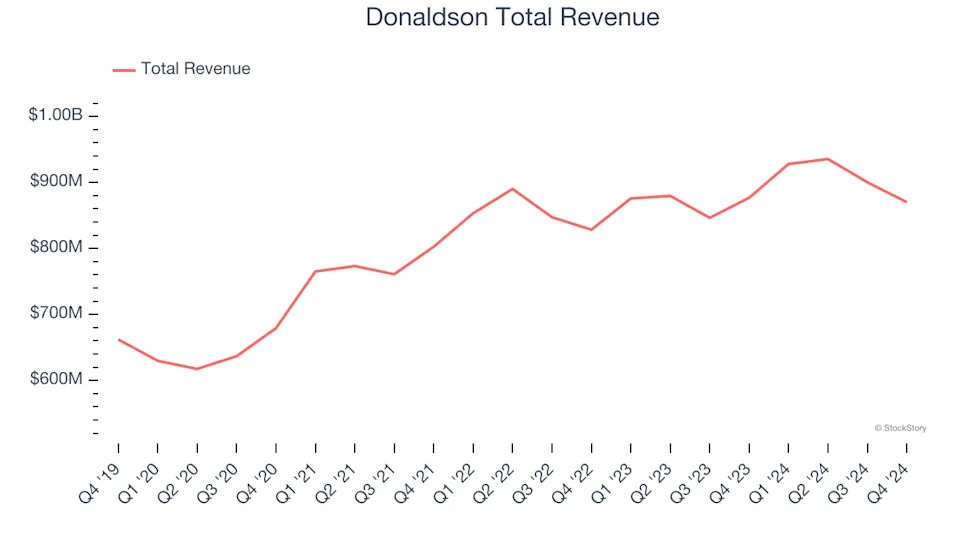

Donaldson (NYSE:DCI)

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE:DCI) manufacturers and sells filtration equipment for various industries.

Donaldson reported revenues of $870 million, flat year on year. This print fell short of analysts’ expectations by 4.2%. Overall, it was a softer quarter for the company with a significant miss of analysts’ constant currency revenue estimates and a miss of analysts’ adjusted operating income estimates.

“The Donaldson team delivered robust margins this quarter, displaying resilience and agility despite ongoing macroeconomic headwinds,” said Tod Carpenter, chairman, president and chief executive officer.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $68.79.

Read our full report on Donaldson here, it’s free .

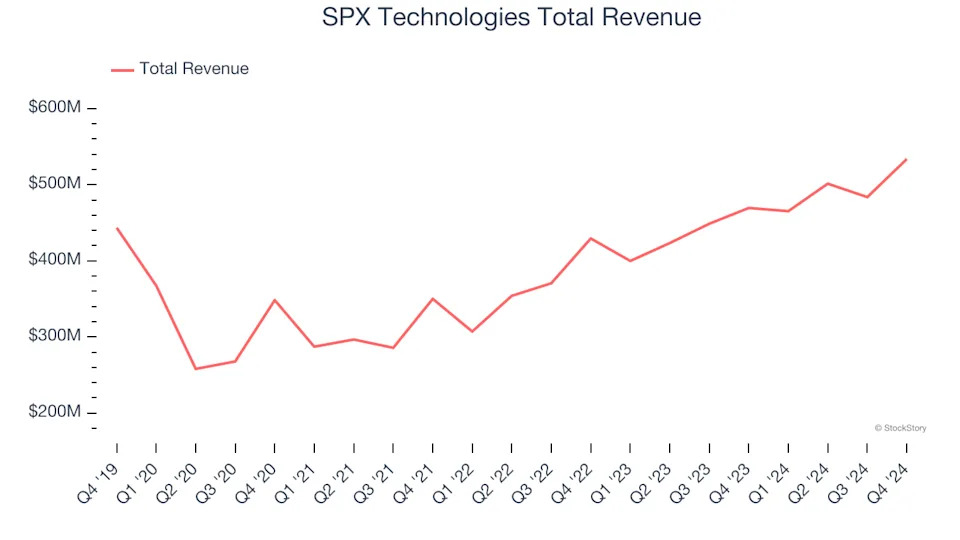

Best Q4: SPX Technologies (NYSE:SPXC)

SPX Technologies (NYSE:SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $533.7 million, up 13.7% year on year, in line with analysts’ expectations. The business had a very strong quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

SPX Technologies scored the fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $136.67.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free .