A $1.8 Trillion ESG Market Is Being Driven by the US Government

(Bloomberg) -- A $1.8 trillion corner of the sustainable debt market is defying the wider downturn as investors snap up bonds sold largely by US government agencies even as Donald Trump leads a green retreat.

Most Read from Bloomberg

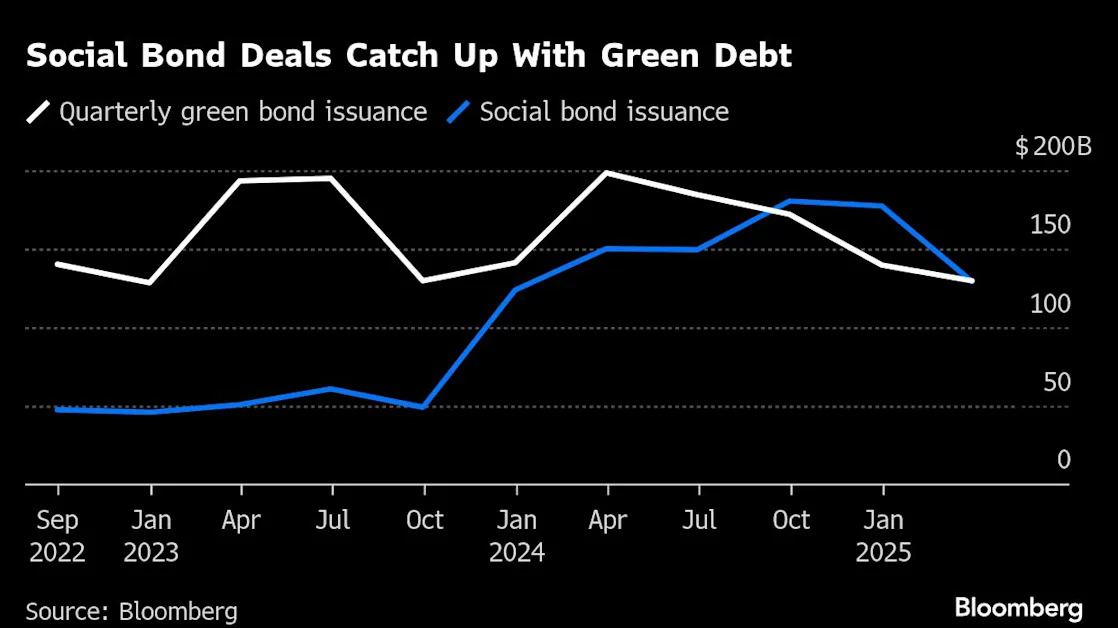

Sales of so-called social bonds, which direct proceeds to areas like health, housing and education, jumped about 130% to $657 billion globally last year, and continued at a similar pace in the first quarter, according to data compiled by Bloomberg Intelligence. Issuance now rivals the traditionally larger market for green bonds, the data show.

Social bonds have emerged as a shelter of sorts for ESG investors, as climate-related issues become increasingly contentious with Trump pulling green funding and promoting fossil fuels. The bonds now have $1.8 trillion outstanding, closing the gap with green bonds at $3.9 trillion.

The flow of social bond deals may continue “even if there is a backtrack on some climate commitments,” said Ulf Erlandsson, chief executive officer of Anthropocene Fixed Income Institute, a non-profit that promotes debt markets to mitigate climate change. Still, given the notes are based more on social constructs than science, there are risks the debt is “even more politically sensitive” in the US, he added.

Ironically, the surge in social bond sales has been largely driven by a US agency. The Government National Mortgage Association, known as Ginnie Mae, broadened its debt program, allowing it to sell more debt for projects aimed at low-income households and veterans, among other groups. It also retroactively labeled some existing securities as social bonds in 2023, boosting the issuance total.

The US housing agencies have been responsible for a majority of this year’s $149 billion in new deals, with Ginnie Mae alone accounting for almost two-thirds of that. France’s social debt fund, along with the International Finance Corp. and Korea Housing Finance Corp. have also sold debt this year. Banks underwriting social bond deals include JPMorgan Chase & Co. and BNP Paribas SA.

Ginnie Mae is one of several government agencies targeted for cost cuts by the Trump administration, raising concerns about possible disruption in the mortgage bond market, Bloomberg News reported last month. As many as a quarter of the agency’s 270-or-so employees have either resigned or been dismissed, people familiar with the matter said at the time.