Spotting Winners: Cintas (NASDAQ:CTAS) And Industrial & Environmental Services Stocks In Q4

Looking back on industrial & environmental services stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Cintas (NASDAQ:CTAS) and its peers.

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

The 8 industrial & environmental services stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 1.2% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.4% since the latest earnings results.

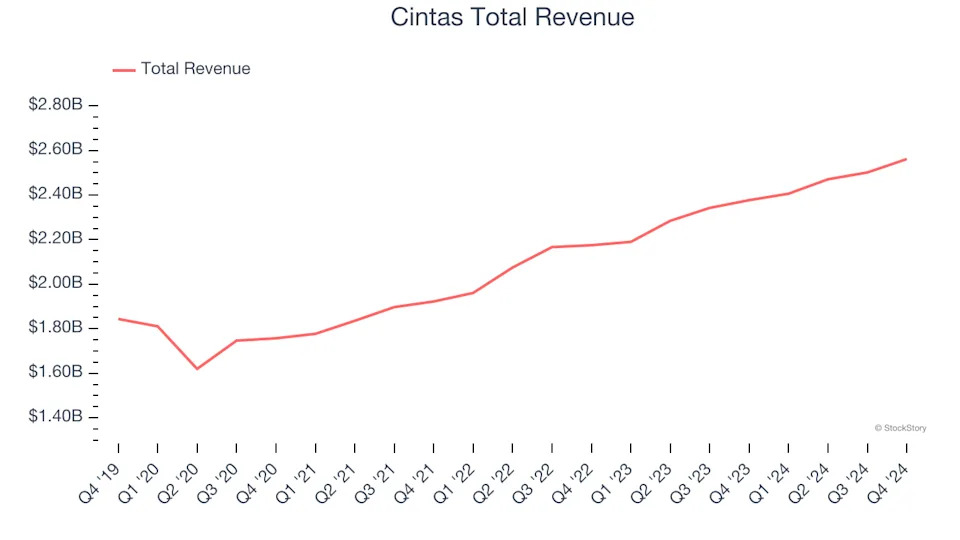

Cintas (NASDAQ:CTAS)

Starting as a family business collecting and cleaning shop rags in Cincinnati, Cintas (NASDAQ:CTAS) provides corporate identity uniforms, facility services, and safety products to over one million businesses across North America.

Cintas reported revenues of $2.56 billion, up 7.8% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and a decent beat of analysts’ full-year EPS guidance estimates.

The stock is down 5.8% since reporting and currently trades at $192.61.

We think Cintas is a good business, but is it a buy today? Read our full report here, it’s free.

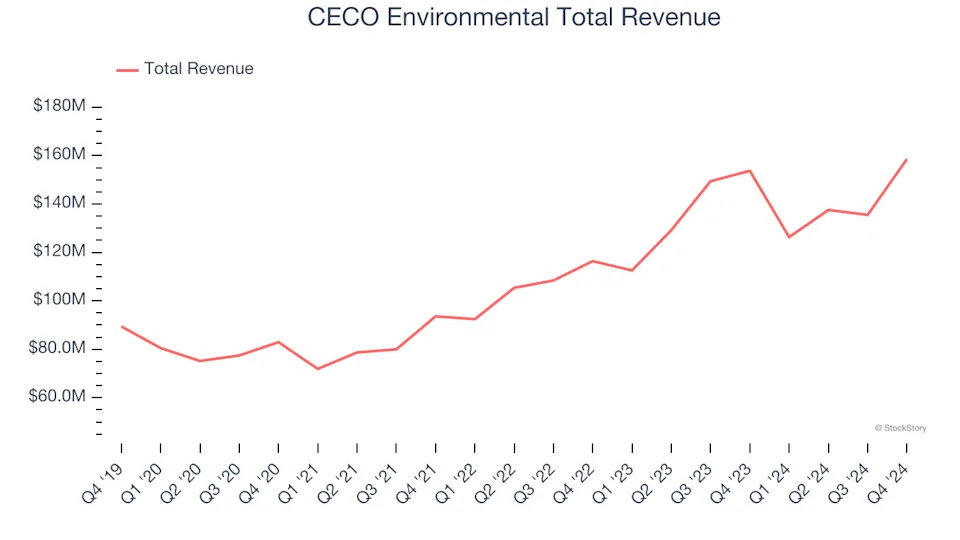

Best Q4: CECO Environmental (NASDAQ:CECO)

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ:CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

CECO Environmental reported revenues of $158.6 million, up 3.2% year on year, outperforming analysts’ expectations by 1.4%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

CECO Environmental achieved the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 5.9% since reporting. It currently trades at $24.01.