Q4 Rundown: Deere (NYSE:DE) Vs Other Agricultural Machinery Stocks

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the agricultural machinery industry, including Deere (NYSE:DE) and its peers.

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

The 6 agricultural machinery stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 6.7% while next quarter’s revenue guidance was 1.9% above.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q4: Deere (NYSE:DE)

Revolutionizing agriculture with the first self-polishing cast-steel plow in the 1800s, Deere (NYSE:DE) manufactures and distributes advanced agricultural, construction, forestry, and turf care equipment.

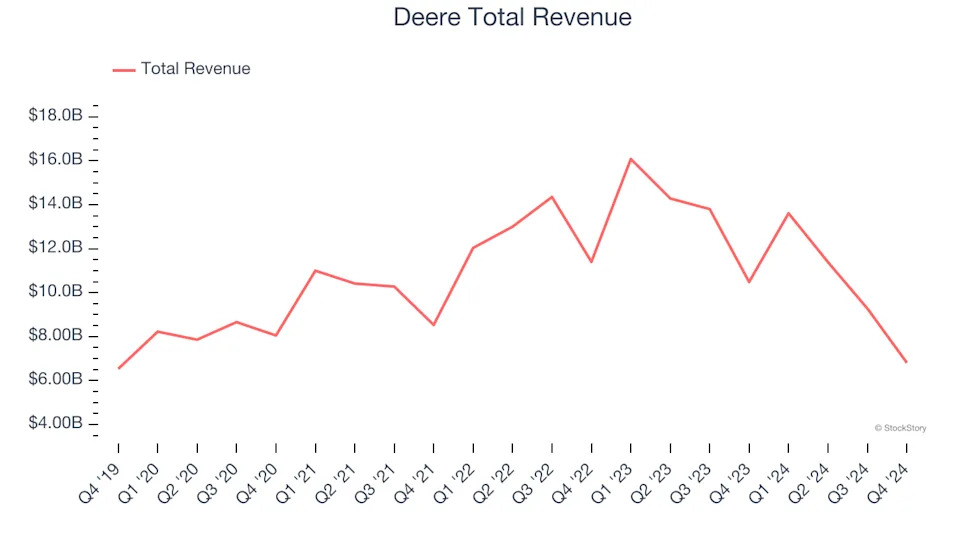

Deere reported revenues of $6.81 billion, down 35.1% year on year. This print fell short of analysts’ expectations by 25.6%. Overall, it was a softer quarter for the company with and a significant miss of analysts’ adjusted operating income estimates.

Deere delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $476.49.

Read our full report on Deere here, it’s free .

Best Q4: Lindsay (NYSE:LNN)

A pioneer in the field of center pivot and lateral move irrigation, Lindsay (NYSE:LNN) provides a variety of proprietary water management and road infrastructure products and services.

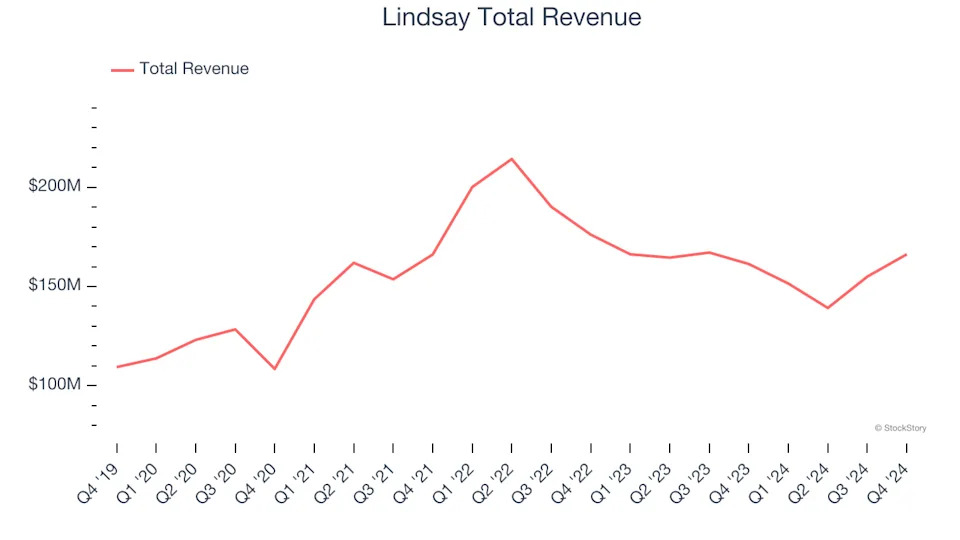

Lindsay reported revenues of $166.3 million, up 3.1% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

Lindsay pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 8.1% since reporting. It currently trades at $127.01.

Is now the time to buy Lindsay? Access our full analysis of the earnings results here, it’s free .