Home Construction Materials Stocks Q4 In Review: Fortune Brands (NYSE:FBIN) Vs Peers

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the home construction materials stocks, including Fortune Brands (NYSE:FBIN) and its peers.

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 12 home construction materials stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.2% since the latest earnings results.

Fortune Brands (NYSE:FBIN)

Targeting a wide customer base of residential and commercial customers, Fortune Brands (NYSE:FBIN) makes plumbing, security, and outdoor living products.

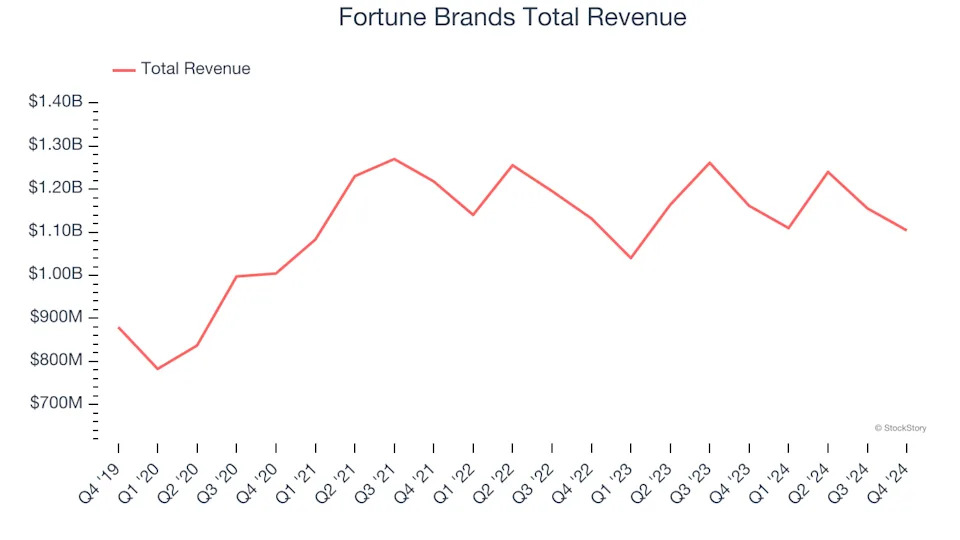

Fortune Brands reported revenues of $1.10 billion, down 4.9% year on year. This print fell short of analysts’ expectations by 3.5%. Overall, it was a disappointing quarter for the company with full-year EPS guidance missing analysts’ expectations.

Fortune Brands delivered the weakest performance against analyst estimates of the whole group. The stock is down 7% since reporting and currently trades at $64.24.

Read our full report on Fortune Brands here, it’s free .

Best Q4: Owens Corning (NYSE:OC)

Credited with the discovery of fiberglass, Owens Corning (NYSE:OC) supplies building and construction materials to the United States and international markets.

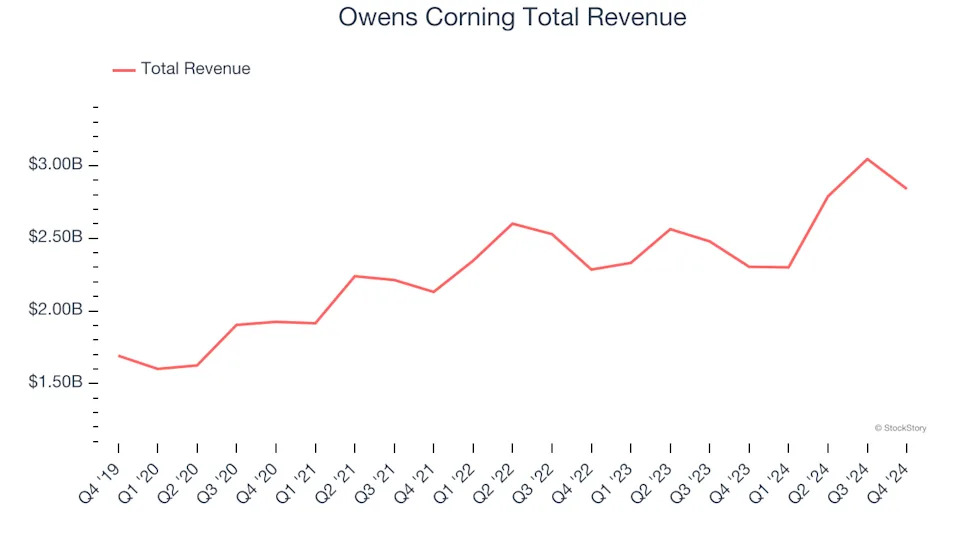

Owens Corning reported revenues of $2.84 billion, up 23.3% year on year, outperforming analysts’ expectations by 2.7%. The business had a stunning quarter with a solid beat of analysts’ organic revenue and EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 11.2% since reporting. It currently trades at $147.01.

Is now the time to buy Owens Corning? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: American Woodmark (NASDAQ:AMWD)

Starting as a small millwork shop, American Woodmark (NASDAQ:AMWD) is a cabinet manufacturing company that helps customers from inspiration to installation.