3 Reasons CRL is Risky and 1 Stock to Buy Instead

Over the last six months, Charles River Laboratories’s shares have sunk to $173.44, producing a disappointing 15.7% loss while the S&P 500 was flat. This might have investors contemplating their next move.

Is now the time to buy Charles River Laboratories, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with CRL and a stock we'd rather own.

Why Is Charles River Laboratories Not Exciting?

Named after the Massachusetts river where it was founded in 1947, Charles River Laboratories (NYSE:CRL) provides non-clinical drug development services, research models, and manufacturing support to pharmaceutical and biotechnology companies.

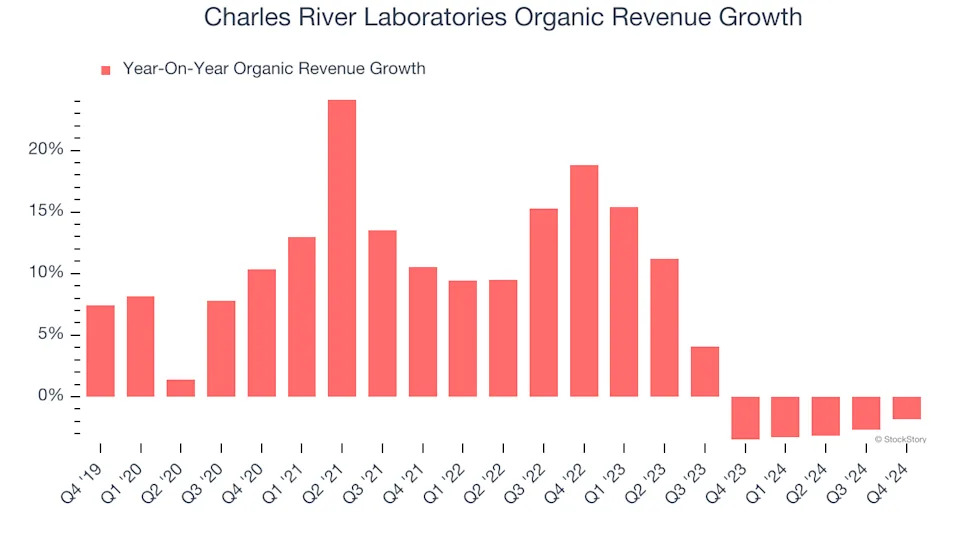

1. Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand Drug Development Inputs & Services companies by analyzing their organic revenue. This metric gives visibility into Charles River Laboratories’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Charles River Laboratories’s organic revenue averaged 2% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Charles River Laboratories’s revenue to drop by 5.5%, a decrease from its flat sales for the past two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

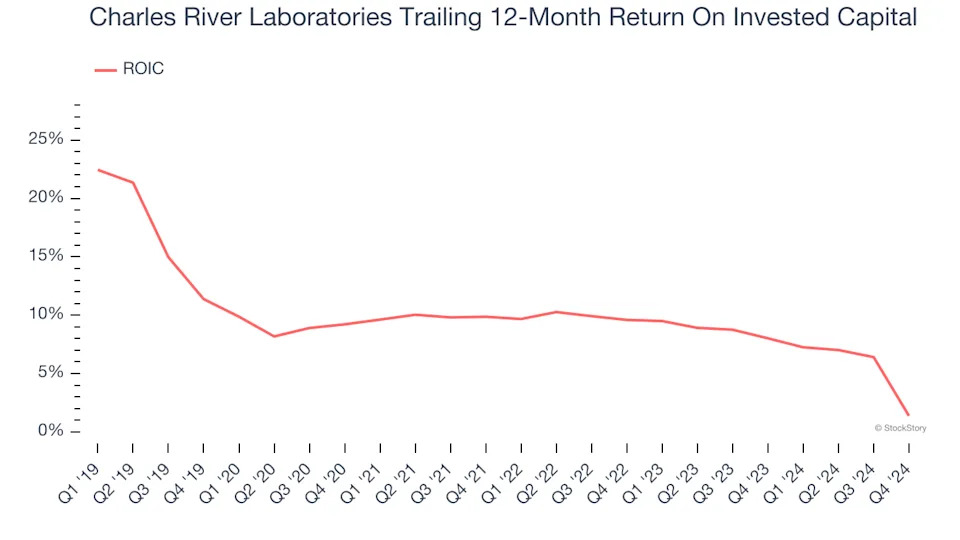

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Charles River Laboratories’s ROIC averaged 4.8 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.