Hardware & Infrastructure Stocks Q4 In Review: Diebold Nixdorf (NYSE:DBD) Vs Peers

Let’s dig into the relative performance of Diebold Nixdorf (NYSE:DBD) and its peers as we unravel the now-completed Q4 hardware & infrastructure earnings season.

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

The 9 hardware & infrastructure stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.5% since the latest earnings results.

Diebold Nixdorf (NYSE:DBD)

With roots dating back to 1859 and a presence in over 100 countries, Diebold Nixdorf (NYSE:DBD) provides automated self-service technology, software, and services that help banks and retailers digitize their customer transactions.

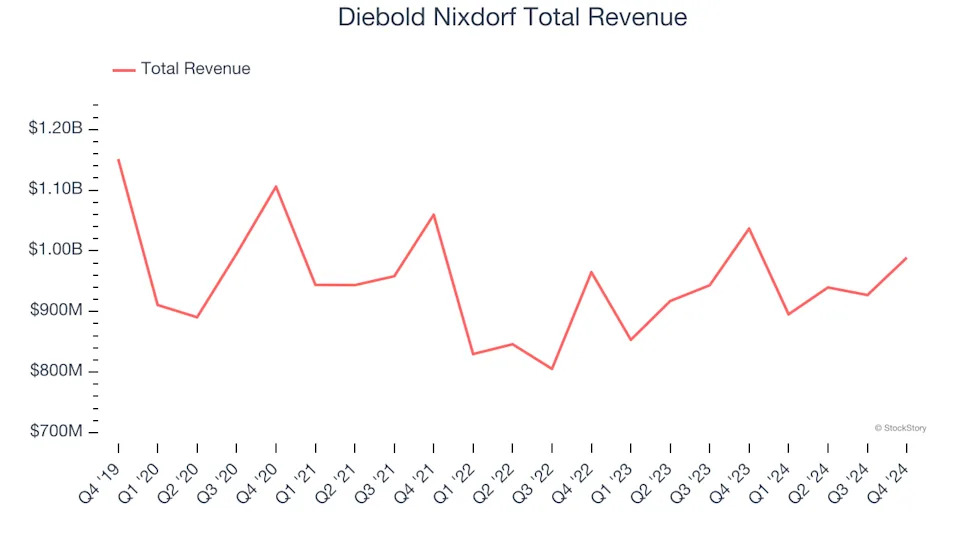

Diebold Nixdorf reported revenues of $988.9 million, down 4.6% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates.

The stock is down 1.5% since reporting and currently trades at $43.30.

Read our full report on Diebold Nixdorf here, it’s free .

Best Q4: Pure Storage (NYSE:PSTG)

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE:PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

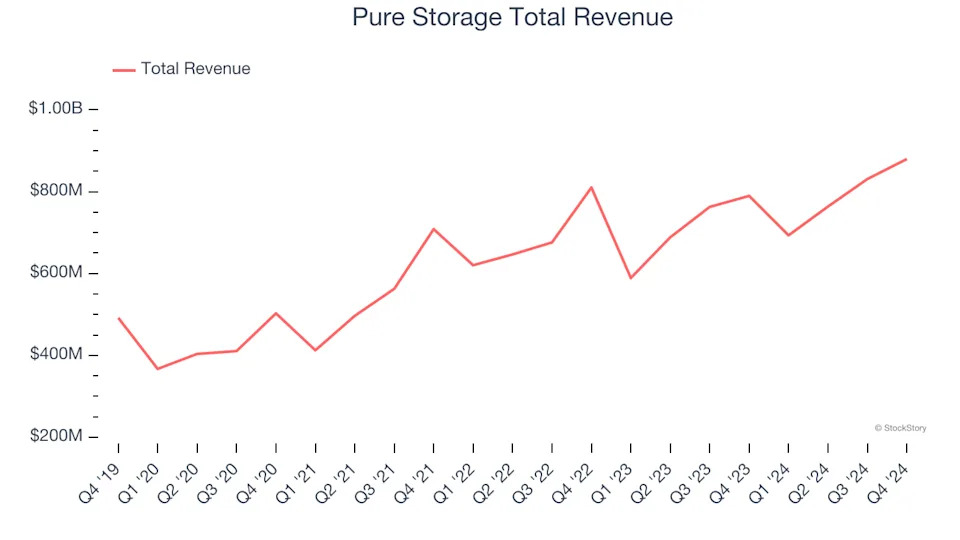

Pure Storage reported revenues of $879.8 million, up 11.4% year on year, outperforming analysts’ expectations by 1.2%. The business had a satisfactory quarter with an impressive beat of analysts’ EPS estimates but billings in line with analysts’ estimates.

Pure Storage scored the highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 16.7% since reporting. It currently trades at $52.