3 Reasons to Sell PACB and 1 Stock to Buy Instead

Shareholders of PacBio would probably like to forget the past six months even happened. The stock dropped 35.2% and now trades at $1.25. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in PacBio, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even though the stock has become cheaper, we don't have much confidence in PacBio. Here are three reasons why we avoid PACB and a stock we'd rather own.

Why Do We Think PacBio Will Underperform?

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ:PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

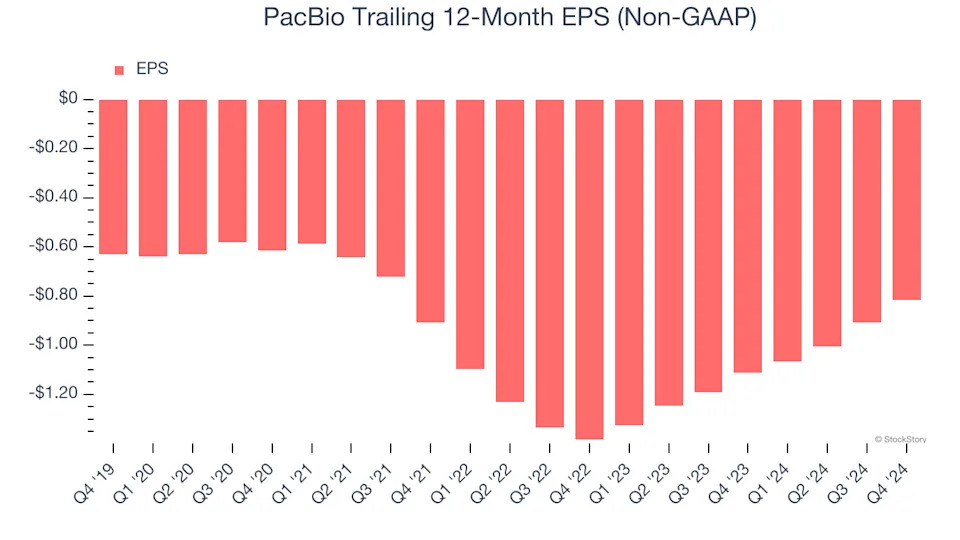

1. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

PacBio’s earnings losses deepened over the last five years as its EPS dropped 5.3% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, PacBio’s low margin of safety could leave its stock price susceptible to large downswings.

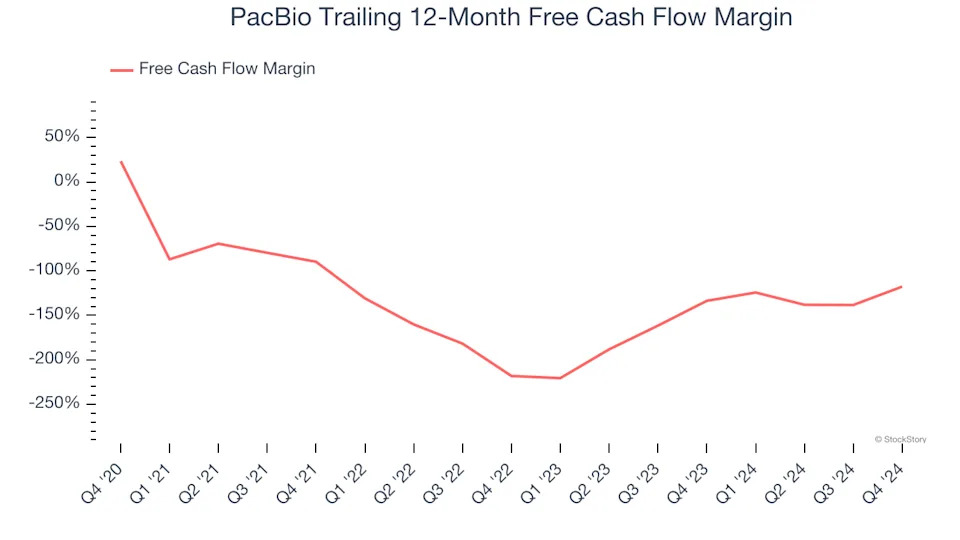

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, PacBio’s margin dropped meaningfully over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. PacBio’s free cash flow margin for the trailing 12 months was negative 118%.

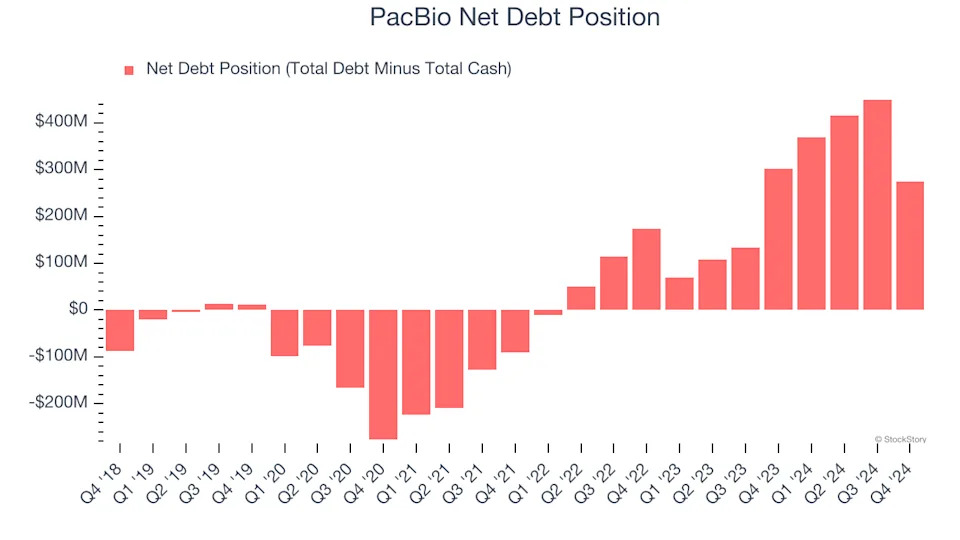

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.