General Industrial Machinery Stocks Q3 Results: Benchmarking John Bean (NYSE:JBT)

Looking back on general industrial machinery stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including John Bean (NYSE:JBT) and its peers.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 15 general industrial machinery stocks we track reported a slower Q3. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 2.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.2% since the latest earnings results.

John Bean (NYSE:JBT)

Tracing back to its invention of the mechanical milk bottle filler in 1884, John Bean (NYSE:JBT) designs, manufactures, and sells equipment used for food processing and aviation.

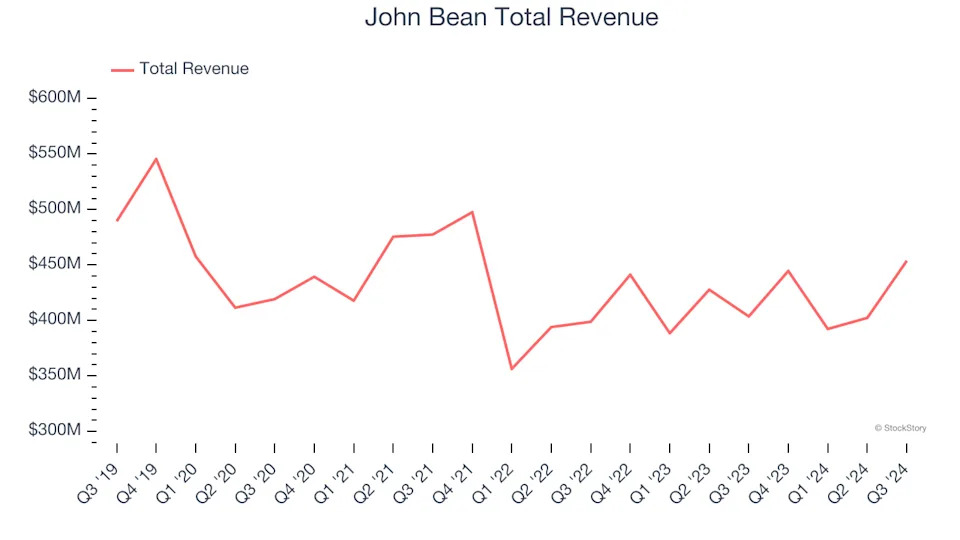

John Bean reported revenues of $453.8 million, up 12.4% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ organic revenue estimates.

"We are pleased with our third quarter execution, which enabled record quarterly revenue, adjusted EBITDA, and adjusted EPS from continuing operations," said Brian Deck, President and Chief Executive Officer.

John Bean scored the highest full-year guidance raise of the whole group. The stock is up 31.6% since reporting and currently trades at $125.32.

Is now the time to buy John Bean? Access our full analysis of the earnings results here, it’s free .

Best Q3: GE Aerospace (NYSE:GE)

One of the original 12 companies on the Dow Jones Industrial Average, General Electric (NYSE:GE) is a multinational conglomerate providing technologies for various sectors including aviation, power, renewable energy, and healthcare.

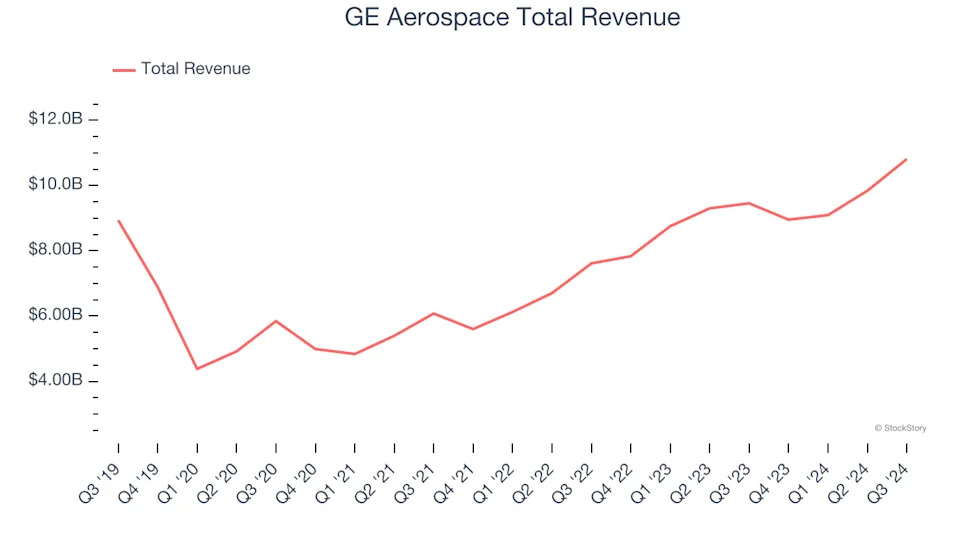

GE Aerospace reported revenues of $10.81 billion, up 14.3% year on year, outperforming analysts’ expectations by 13.7%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

GE Aerospace delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 7.3% since reporting. It currently trades at $201.98.