3 Reasons to Sell HSIC and 1 Stock to Buy Instead

Since September 2024, Henry Schein has been in a holding pattern, floating around $72.51.

Is there a buying opportunity in Henry Schein, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

We're sitting this one out for now. Here are three reasons why there are better opportunities than HSIC and a stock we'd rather own.

Why Is Henry Schein Not Exciting?

With a vast inventory of over 300,000 products stocked in distribution centers spanning more than 5.3 million square feet worldwide, Henry Schein (NASDAQ:HSIC) is a global distributor of healthcare products and services primarily to dental practices, medical offices, and other healthcare facilities.

1. Core Business Falling Behind as Demand Declines

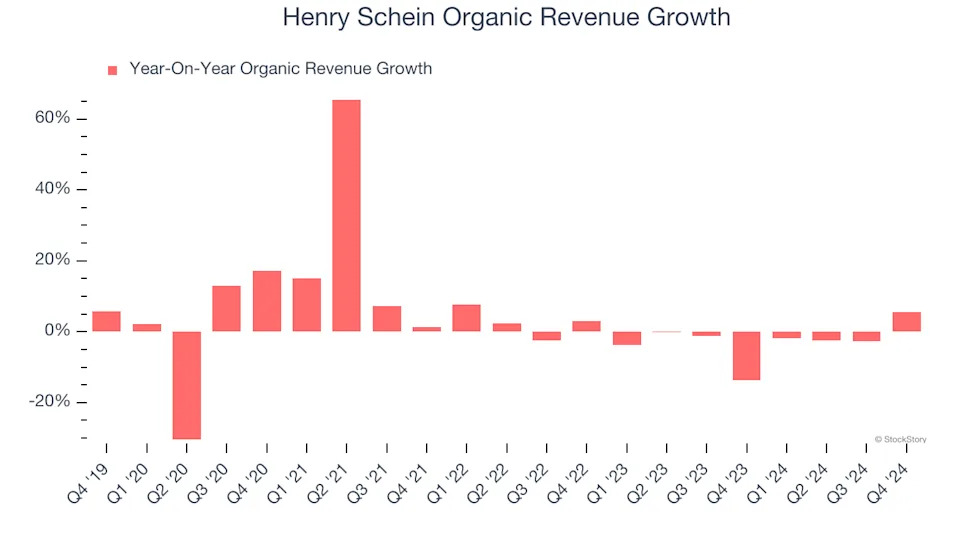

In addition to reported revenue, organic revenue is a useful data point for analyzing Dental Equipment & Technology companies. This metric gives visibility into Henry Schein’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Henry Schein’s organic revenue averaged 2.5% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Henry Schein might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Henry Schein’s revenue to rise by 2.7%. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

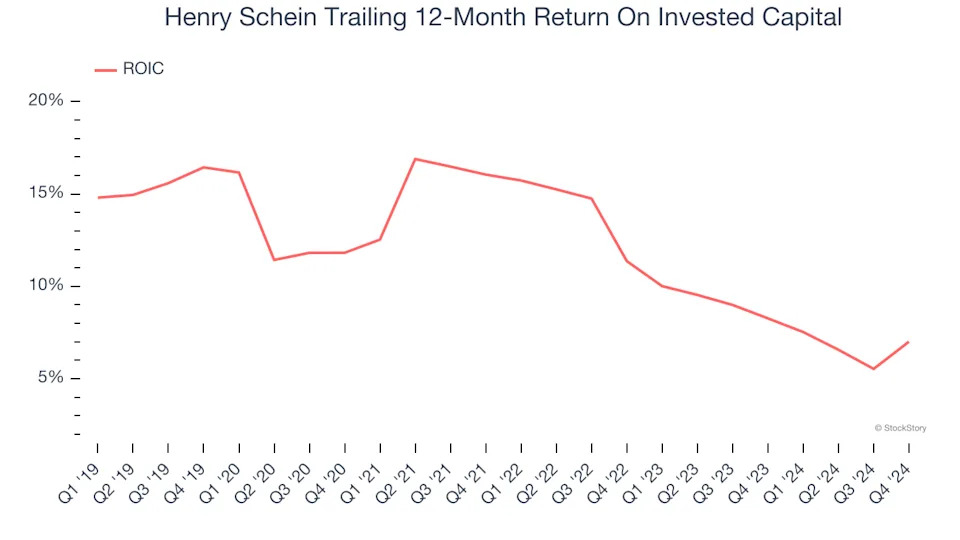

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Henry Schein’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.