Spotting Winners: Omnicom Group (NYSE:OMC) And Advertising & Marketing Services Stocks In Q4

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how advertising & marketing services stocks fared in Q4, starting with Omnicom Group (NYSE:OMC).

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

The 6 advertising & marketing services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 14.3% since the latest earnings results.

Omnicom Group (NYSE:OMC)

With a vast network of creative agencies that helped craft some of the most memorable ad campaigns in history, Omnicom Group (NYSE:OMC) is a strategic holding company that provides advertising, marketing, and communications services to many of the world's largest companies.

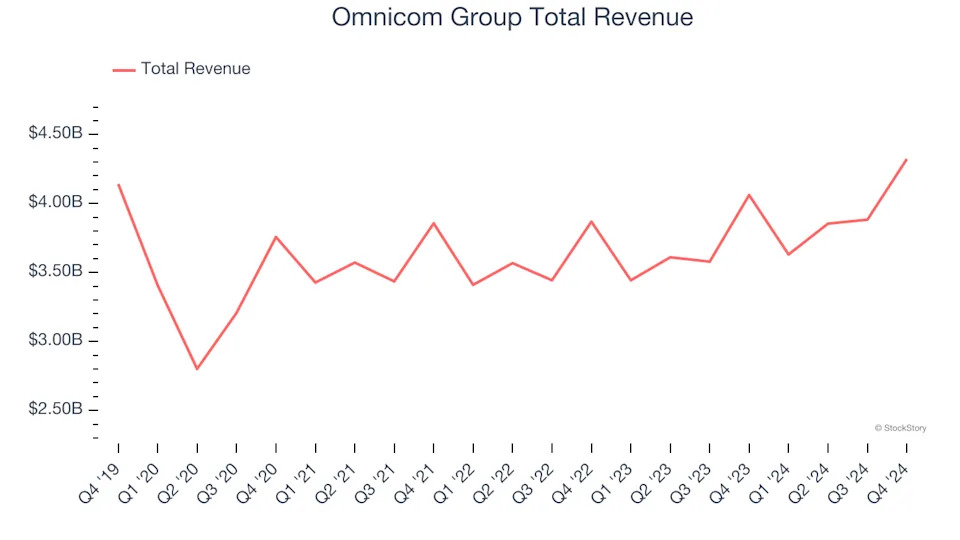

Omnicom Group reported revenues of $4.32 billion, up 6.4% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a narrow beat of analysts’ organic revenue estimates.

The stock is down 7% since reporting and currently trades at $80.83.

Is now the time to buy Omnicom Group? Access our full analysis of the earnings results here, it’s free .

Best Q4: Liberty Broadband (NASDAQ:LBRDK)

Operating across the United States, Liberty Broadband (NASDAQ:LBRDK) is a provider of high-speed internet, cable television, and telecommunications services across various markets.

Liberty Broadband reported revenues of $263 million, up 5.2% year on year, outperforming analysts’ expectations by 0.9%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $80.45.