3 Reasons DOLE is Risky and 1 Stock to Buy Instead

Over the past six months, Dole’s stock price fell to $13.81. Shareholders have lost 17.5% of their capital, disappointing when considering the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Dole, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even with the cheaper entry price, we're swiping left on Dole for now. Here are three reasons why DOLE doesn't excite us and a stock we'd rather own.

Why Do We Think Dole Will Underperform?

Known for its delicious pineapples and Hawaiian roots, Dole (NYSE:DOLE) is a global agricultural company specializing in fresh fruits and vegetables.

1. Revenue Spiraling Downwards

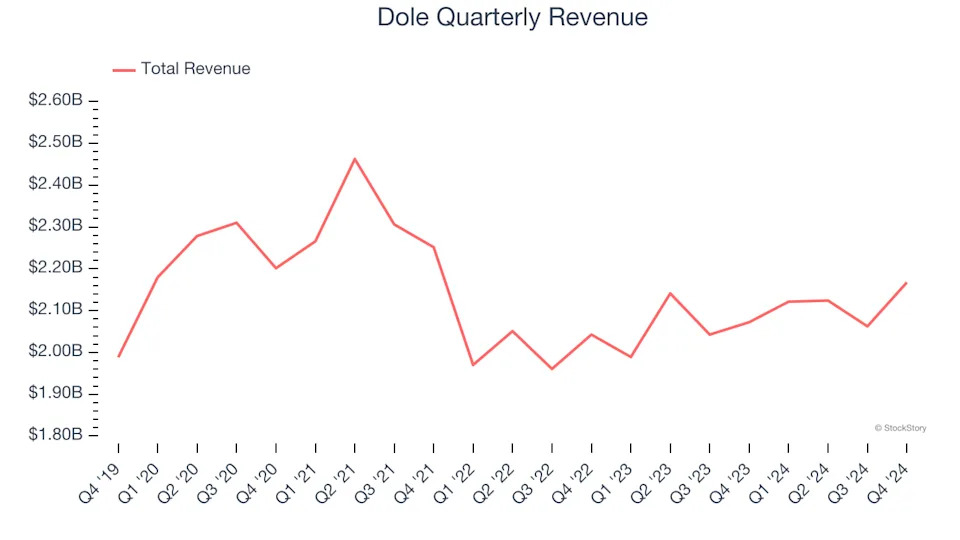

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Dole’s demand was weak over the last three years as its sales fell at a 3% annual rate. This wasn’t a great result and is a sign of poor business quality.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Dole’s revenue to stall. While this projection implies its newer products will fuel better top-line performance, it is still below average for the sector.

3. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Dole has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 8.4% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $91.56 went towards paying for raw materials, production of goods, transportation, and distribution.

Final Judgment

Dole falls short of our quality standards. After the recent drawdown, the stock trades at 10.1× forward price-to-earnings (or $13.81 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy .