Q4 Rundown: LiveRamp (NYSE:RAMP) Vs Other Advertising Software Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at LiveRamp (NYSE:RAMP) and the best and worst performers in the advertising software industry.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 7 advertising software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 29.9% since the latest earnings results.

LiveRamp (NYSE:RAMP)

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

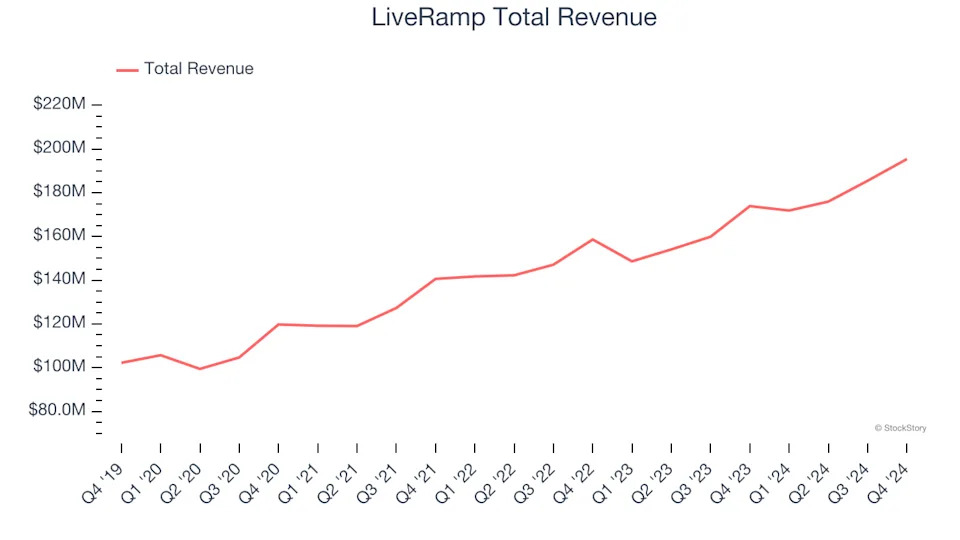

LiveRamp reported revenues of $195.4 million, up 12.4% year on year. This print exceeded analysts’ expectations by 1.7%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but decelerating customer growth.

LiveRamp delivered the weakest full-year guidance update of the whole group. The company kept the number of enterprise customers paying more than $1 million annually flat at a total of 125. Unsurprisingly, the stock is down 26.1% since reporting and currently trades at $25.52.

Is now the time to buy LiveRamp? Access our full analysis of the earnings results here, it’s free .

Best Q4: Zeta (NYSE:ZETA)

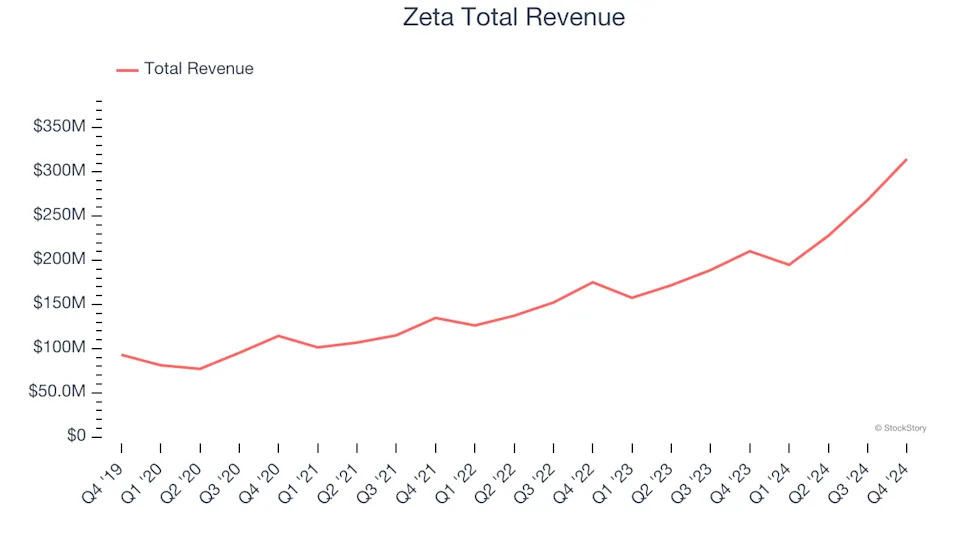

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $314.7 million, up 49.6% year on year, outperforming analysts’ expectations by 6.7%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and EBITDA guidance for the next quarter, exceeding analysts’ expectations.

Zeta achieved the fastest revenue growth and highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 32.5% since reporting. It currently trades at $13.90.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: The Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.