3 Reasons to Avoid SG and 1 Stock to Buy Instead

Sweetgreen has gotten torched over the last six months - since September 2024, its stock price has dropped 29.9% to $23.64 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Sweetgreen, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Despite the more favorable entry price, we're cautious about Sweetgreen. Here are three reasons why you should be careful with SG and a stock we'd rather own.

Why Is Sweetgreen Not Exciting?

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

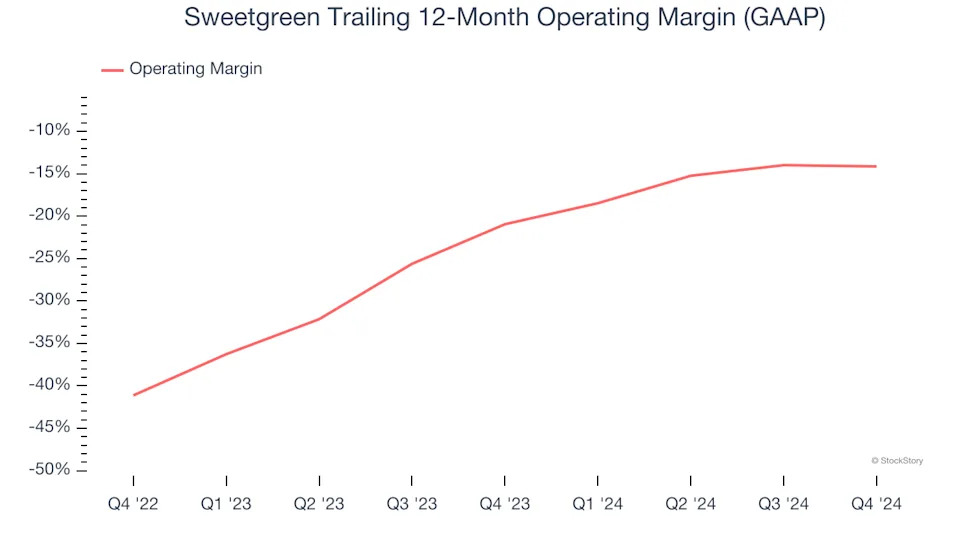

1. Operating Losses Sound the Alarms

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients skyrocketing thanks to supply shortages.Sweetgreen has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 17.3%.

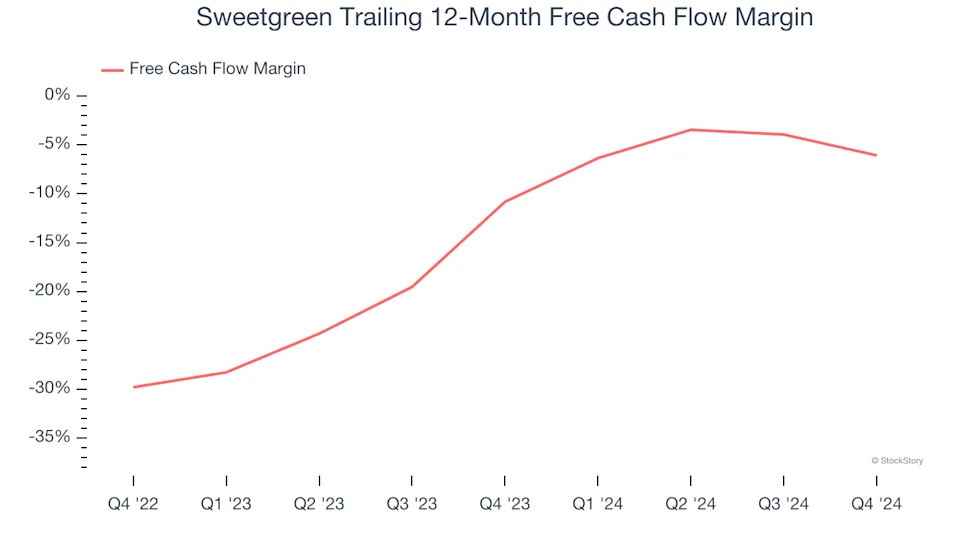

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Sweetgreen’s capital-intensive business model and large investments in new physical locations have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 8.3%, meaning it lit $8.27 of cash on fire for every $100 in revenue.

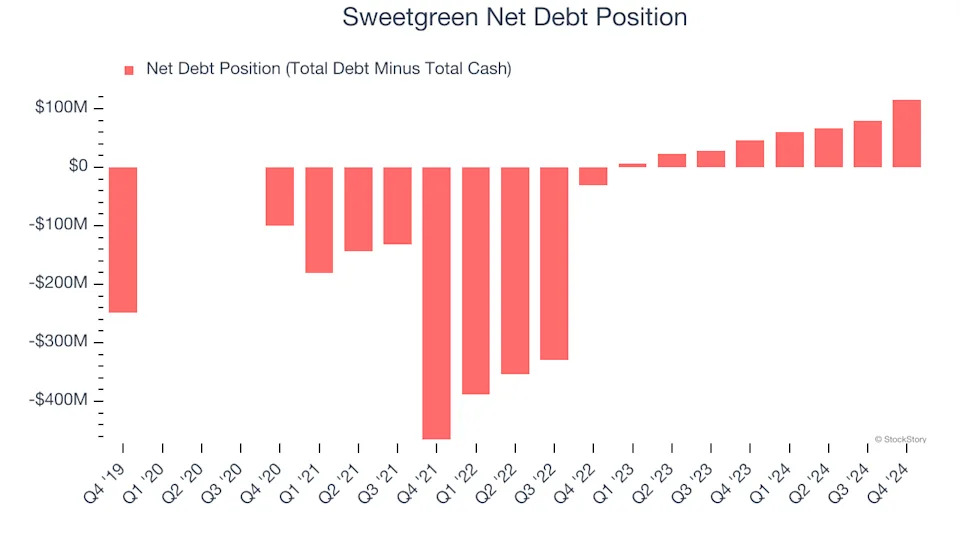

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Sweetgreen burned through $41.07 million of cash over the last year, and its $330.7 million of debt exceeds the $214.8 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.