Elite Colleges in Trump’s Crosshairs Rush to Bond Market at Record Pace

(Bloomberg) -- America’s most prestigious colleges are rushing to the debt market at the fastest pace on record, locking in financing while they can to pay for campus projects or refinance debt against a backdrop of tax and funding threats.

Most Read from Bloomberg

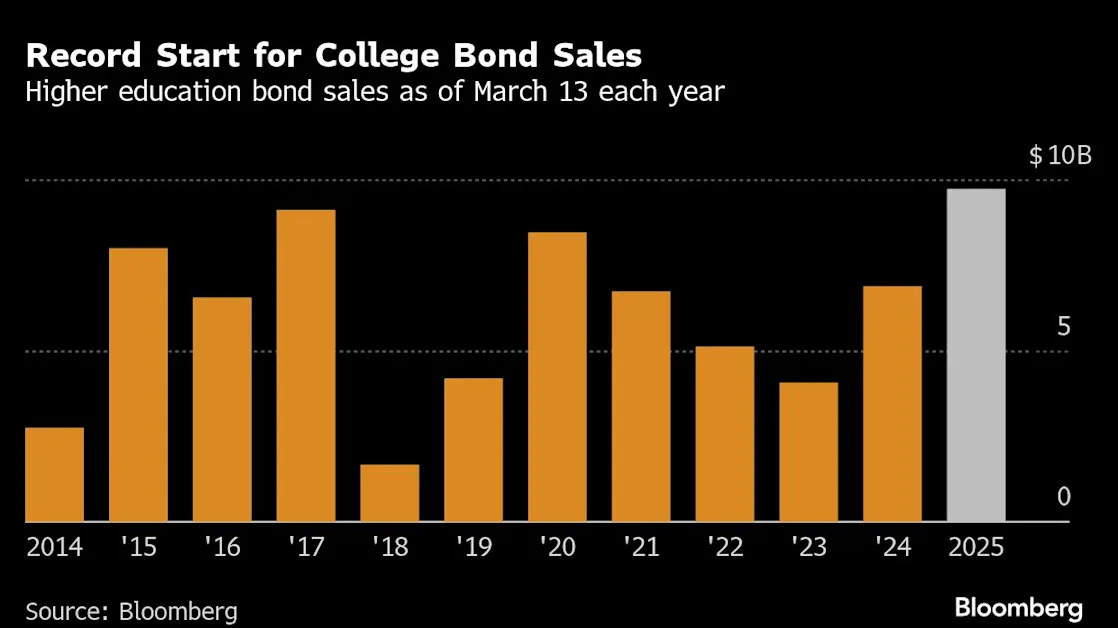

Municipal bond sales for higher education are up more than 40% so far in 2025 compared to the same period a year earlier, reaching nearly $10 billion and eclipsing the prior record start to a year in 2017, according to data compiled by Bloomberg. The sector is outpacing the broader market even as issuance of state and local government debt as a whole runs hot.

From Ivy League institutions such as Harvard University and the University of Pennsylvania to other elite colleges such as Stanford University and Smith College, schools are crowding in to sell bonds, all within the span of weeks. Next up are borrowers including Colgate University — and the barrage is nowhere near done.

The latest frenzy marks a sharp acceleration of an issuance trend that had been playing out in recent months. And while the jolt in sales isn’t the result of new or emergency funding needs, it can trace its source — as in 2017 — to worries that the newly installed Trump administration and Republican majority in Congress will push through changes in tax and other policies that could threaten these colleges’ finances or borrowing status.

Specifically, elite schools are facing the specter of rollbacks in federal research funding as well as the potential for the endowment tax to be raised as part of the GOP’s push to extend soon-expiring tax cuts that were enacted during President Donald Trump’s first term. Some colleges are also moving up bond sales amid worries that they may lose their ability to sell tax-exempt debt entirely, said Doug Brown, co-head of higher education for Wells Fargo & Co.’s public finance group.

“The Ivies and high-rated schools are very sophisticated borrowers who are facing a lot of uncertainty and are able to act quickly,” he said in an interview. “We’ve seen acceleration of timing and the consideration of different debt structures to address some of that risk.”

Some schools are looking at other ways to shore up liquidity, too, such as commercial paper, Brown said. Others, including Northwestern University and Stanford, also recently tapped the corporate bond market as a source of financing in addition to the traditional muni market.

Sounding a Warning

Northwestern, based near Chicago in Evanston, Illinois, warned investors in bond documents for its most recent offering that potential federal and executive actions could have a “material” impact on the school, including its ability to sell tax-exempt bonds. Colgate, a liberal arts school in New York, and Earlham College, a wealthy school in Indiana, nodded to a similar risk in their respective bond documents.

With tax threats looming, some colleges are employing borrowing techniques that will help mitigate this risk. Harvard this month raised $434 million by selling tax-exempt bonds. A portion of the debt matures in 2055, but features a mandatory “put” in 2032 — signaling the school will buy back the bonds at the earlier date seven years from now. As a result, the offering — with proceeds to be used in part to finance projects like the renovation of its distinctive boathouse — priced at an interest rate comparable to seven-year debt rather than 30-year securities.

The structure also will allow Harvard to remarket the bonds in 2032 as tax-exempt even if private colleges lose their ability to issue traditional tax-exempt bonds in the meantime. Stanford sold bonds with a similar structure.

To be sure, worries that flared in 2017 around schools’ tax-exempt status eventually dissipated as the threat receded, and that may happen again should colleges be spared in the coming tax debates. But college finances still face strains from threatened federal research cutbacks under Trump, who has also targeted some top schools including Columbia University for what he sees as a failure to curb antisemitism on campus.

Even before Trump took office, colleges had been ramping up bond sales since last year after holding off in 2022 and 2023, when benchmark interest rates were on the rise. Many pent-up infrastructure needs still unmet, that trend is seen persisting.

‘Good Time’

Northwestern, which sold $500 million of taxable bonds this month, is considering selling tax-exempt debt in 2025 to fund a portion of its capital plan, the school said in bond documents. Northeastern University in Boston just received authorization to sell up to $650 million of bonds through a state agency, and Wellesley College is also planning to sell bonds through the same entity. Boston College, meanwhile, sold bonds for renovations to its campus in Brookline.

A spokesperson for Boston College said the school’s financing wasn’t in response to actions by the federal government and instead came out of an established process. And a spokesperson for Stanford said the school’s bond sale was also part of the university’s normal course of business.

Some colleges put borrowing plans on hold during Covid, and it’s taking time to see projects restarted, said Megan DeGrass, a financial adviser and banker for colleges at Hilltop Securities. Borrowing costs are relatively attractive and schools are looking to avoid any volatility later this year by issuing bonds now.

Municipal-bond yields are considered low compared to US Treasuries, which is one metric that colleges consider before selling tax-exempt debt. Lower-rated colleges have also been flocking to the bond market to start 2025.

“There is a realization that funding costs may go up – it’s a good time to lock in borrowing costs while rates are at this level,” she said.

--With assistance from Shruti Date Singh.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.