3 Reasons IART is Risky and 1 Stock to Buy Instead

While the broader market has struggled with the S&P 500 down 1.3% since September 2024, Integra LifeSciences has surged ahead as its stock price has climbed by 31.6% to $22.79 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Integra LifeSciences, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the momentum, we don't have much confidence in Integra LifeSciences. Here are three reasons why there are better opportunities than IART and a stock we'd rather own.

Why Do We Think Integra LifeSciences Will Underperform?

Founded in 1989, Integra LifeSciences (NASDAQ:IART) develops, manufactures, and markets a broad portfolio of surgical and critical care solutions, including advanced wound care, neurosurgery, and orthopedic products.

1. Core Business Falling Behind as Demand Plateaus

We can better understand Surgical Equipment & Consumables - Specialty companies by analyzing their organic revenue. This metric gives visibility into Integra LifeSciences’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Integra LifeSciences failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Integra LifeSciences might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

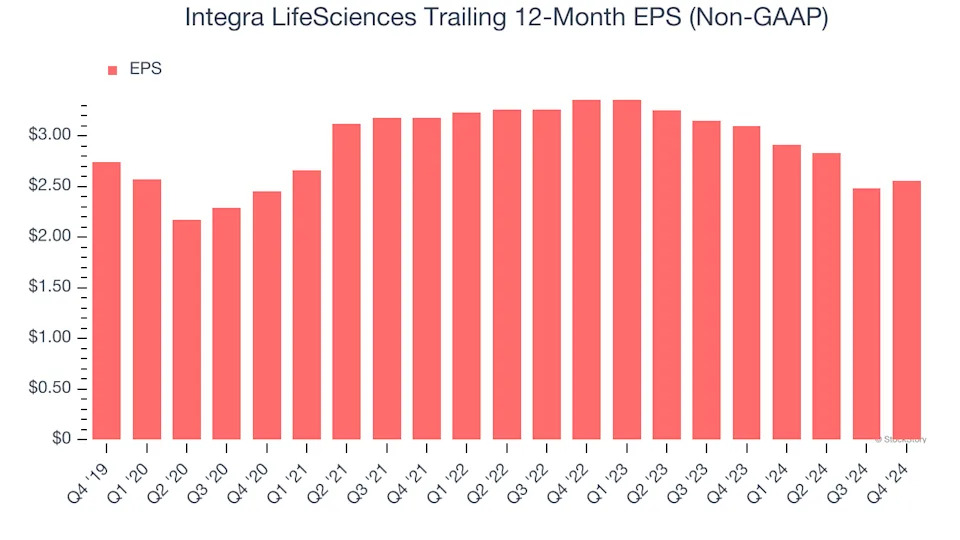

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Integra LifeSciences, its EPS declined by 1.4% annually over the last five years while its revenue grew by 1.2%. This tells us the company became less profitable on a per-share basis as it expanded.

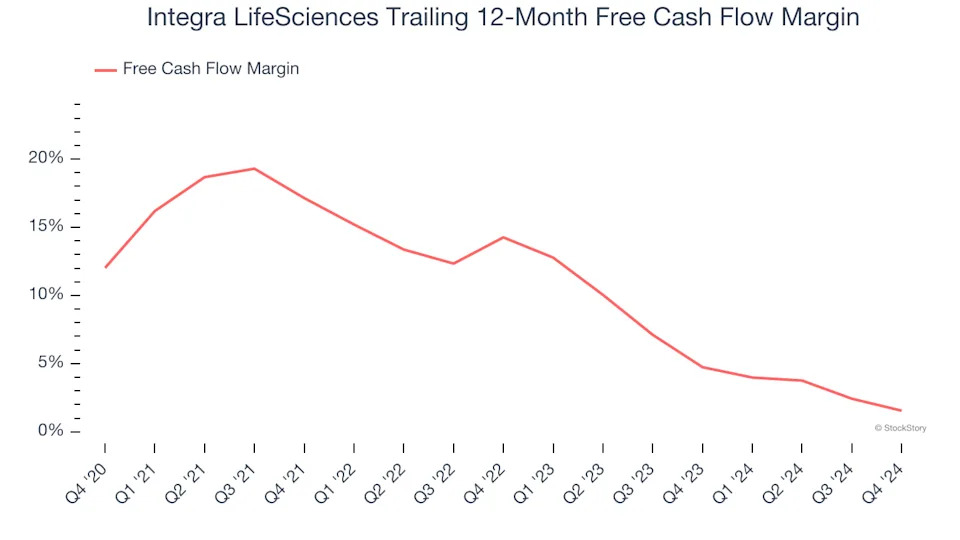

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Integra LifeSciences’s margin dropped by 10.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Integra LifeSciences’s free cash flow margin for the trailing 12 months was 1.6%.