Construction and Maintenance Services Stocks Q4 Results: Benchmarking Comfort Systems (NYSE:FIX)

Looking back on construction and maintenance services stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Comfort Systems (NYSE:FIX) and its peers.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 13 construction and maintenance services stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.9% since the latest earnings results.

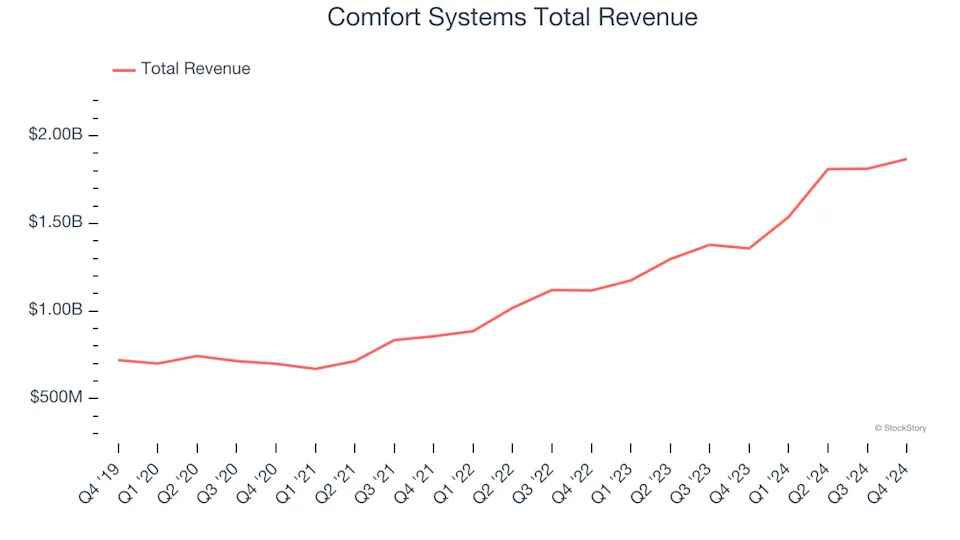

Comfort Systems (NYSE:FIX)

Formed through the merger of 12 companies, Comfort Systems (NYSE:FIX) provides mechanical and electrical contracting services.

Comfort Systems reported revenues of $1.87 billion, up 37.6% year on year. This print exceeded analysts’ expectations by 5.5%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates.

Brian Lane, Comfort Systems USA’s President and Chief Executive Officer, said, “We are reporting record annual and fourth quarter earnings as our amazing teams across the United States continue their excellent performance. Per share earnings in 2024 were over 60% higher than the spectacular results we achieved in 2023, and our strong quarterly results were also without precedent.”

The stock is down 12.9% since reporting and currently trades at $332.89.

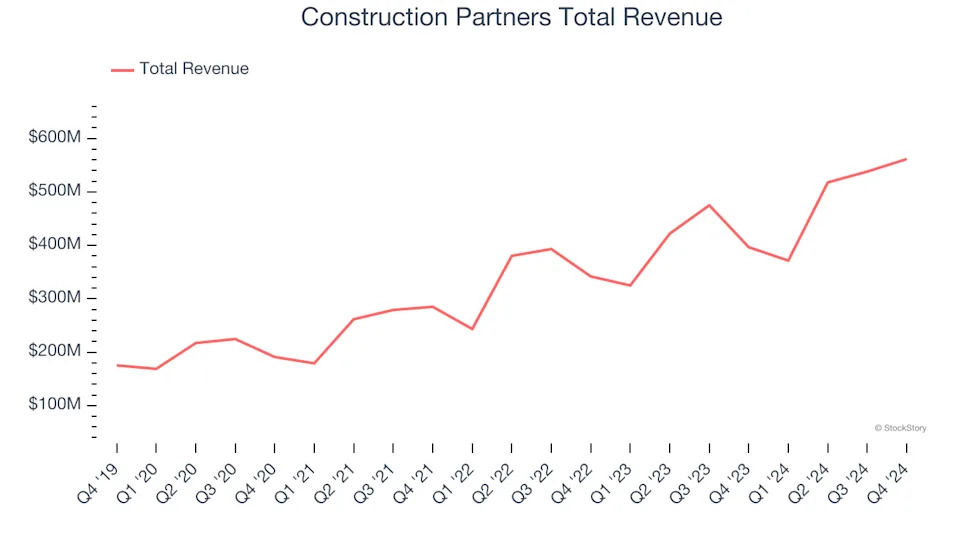

Best Q4: Construction Partners (NASDAQ:ROAD)

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Construction Partners reported revenues of $561.6 million, up 41.6% year on year, outperforming analysts’ expectations by 9.7%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.