Watch These Apple Stock Price Levels as Sell-Off Continues

Key Takeaways

Apple ( AAPL ) shares remained under pressure on Wednesday, bucking a broader rally for tech stocks.

Shares in the iPhone maker have come under heavy selling pressure this week following news that the company is delaying the rollout of several AI features to Siri , which analysts argue could dent iPhone sales. The threat of looming tariffs also continues to weigh on sentiment amid growing concerns that import duties imposed by the Trump administration could eat into the company’s gross margins , given it manufactures the majority of its devices in China.

Apple shares, which experienced their biggest one-day drop in two-and-a-half years on Monday, have fallen 17% since hitting a record high in December. The stock was down 2.2% at $216 in late trading Wednesday.

Below, we take a closer look at Apple’s chart and use technical analysis to identify major price levels worth watching out for.

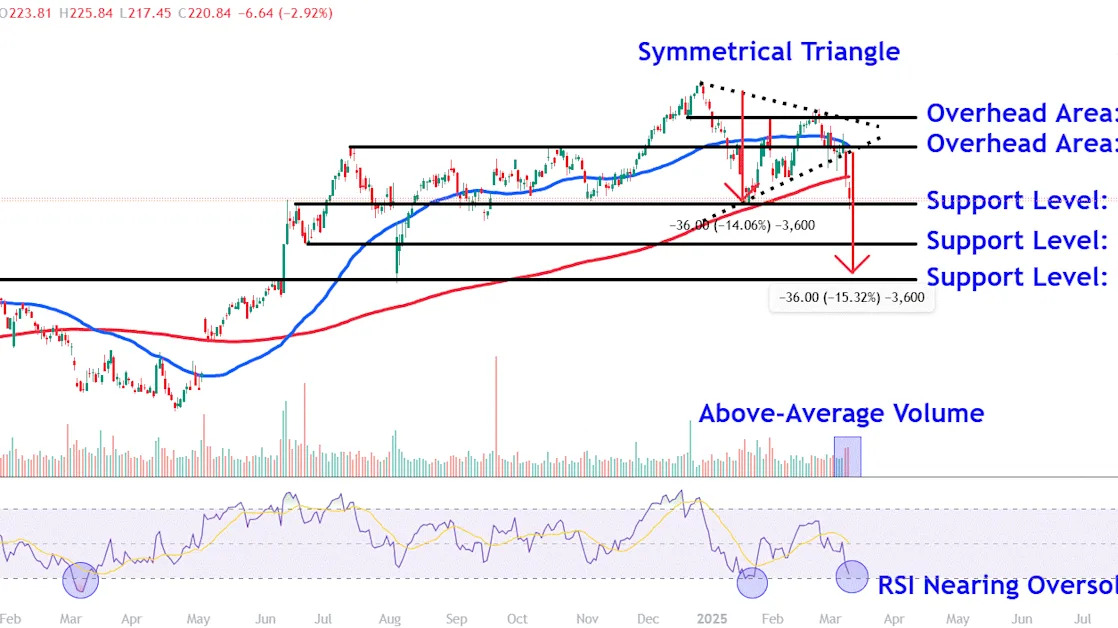

Symmetrical Triangle Breakdown

After setting a record high in late December, Apple shares consolidated within a symmetrical triangle before staging a decisive breakdown below the pattern and closely watched 200-day moving average this week.

Importantly, above-average volume has accompanied the move lower, indicating selling conviction by larger market participants.

While the relative strength index (RSI) confirms bearish price momentum with a reading below 50, the indicator sits near oversold territory, a region that has for several years provided attractive tactical trading opportunities in the stock.

Let’s locate major support levels to watch amid the possibility for further selling and also identify several key overhead areas to monitor if the stock resumes it longer-term uptrend .

Major Support Levels to Watch

Entering Wednesday's session, the $219 level was an area where the stock was expected to find support from a trendline that connects a range of similar price points on the chart between June last year and January this year. The stock had fallen below this location in intraday trading on Tuesday, but it reclaimed the area by yesterday’s close.