3 Reasons to Sell FORM and 1 Stock to Buy Instead

FormFactor has gotten torched over the last six months - since September 2024, its stock price has dropped 26.5% to $31.47 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in FormFactor, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Even though the stock has become cheaper, we're swiping left on FormFactor for now. Here are three reasons why FORM doesn't excite us and a stock we'd rather own.

Why Do We Think FormFactor Will Underperform?

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

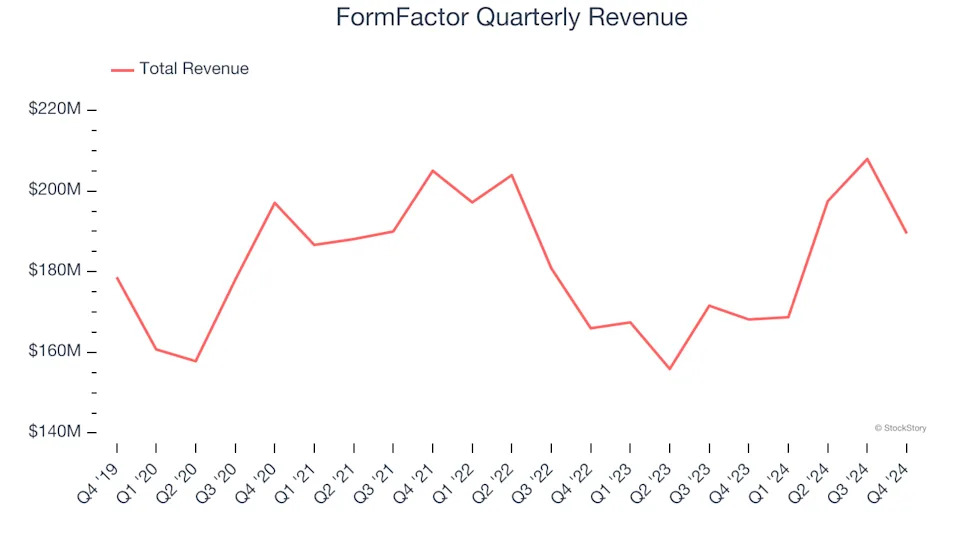

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, FormFactor’s 5.3% annualized revenue growth over the last five years was tepid. This was below our standard for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect FormFactor’s revenue to rise by 2.1%, close to its 1% annualized growth for the past two years. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

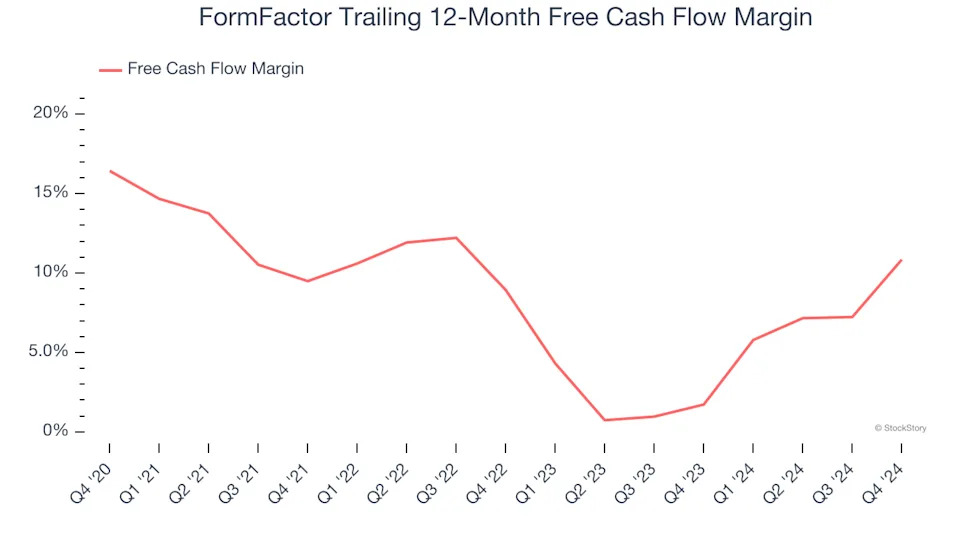

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, FormFactor’s margin dropped by 5.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. FormFactor’s free cash flow margin for the trailing 12 months was 10.8%.