Q4 Earnings Outperformers: Matthews (NASDAQ:MATW) And The Rest Of The Specialized Consumer Services Stocks

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the specialized consumer services stocks, including Matthews (NASDAQ:MATW) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 0.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.4% since the latest earnings results.

Matthews (NASDAQ:MATW)

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

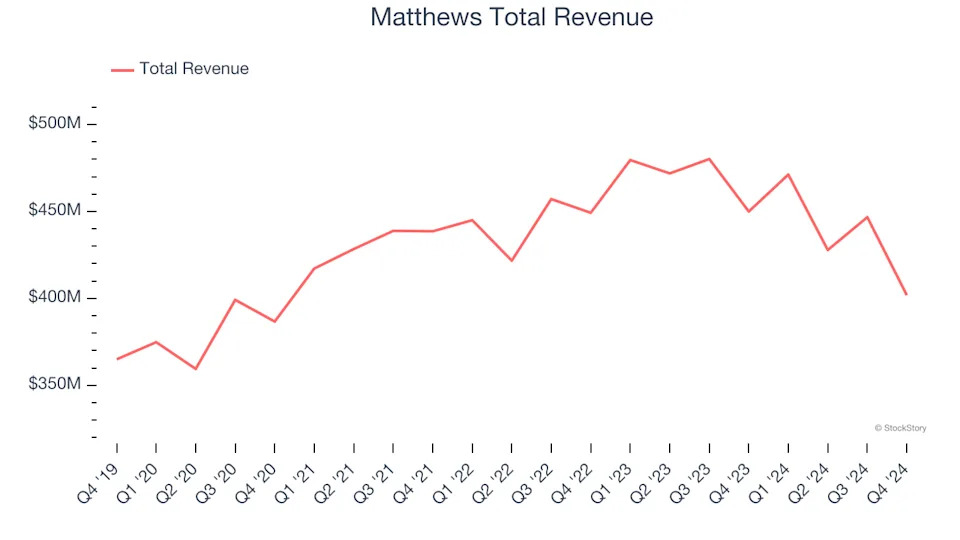

Matthews reported revenues of $401.8 million, down 10.7% year on year. This print fell short of analysts’ expectations by 5.9%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

Matthews delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 17.1% since reporting and currently trades at $24.45.

Read our full report on Matthews here, it’s free .

Best Q4: Frontdoor (NASDAQ:FTDR)

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $383 million, up 4.6% year on year, outperforming analysts’ expectations by 4.1%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Frontdoor achieved the highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 34.2% since reporting. It currently trades at $37.57.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: 1-800-FLOWERS (NASDAQ:FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.