Specialized Consumer Services Q4 Earnings: Frontdoor (NASDAQ:FTDR) Simply the Best

Let’s dig into the relative performance of Frontdoor (NASDAQ:FTDR) and its peers as we unravel the now-completed Q4 specialized consumer services earnings season.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 0.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.9% since the latest earnings results.

Best Q4: Frontdoor (NASDAQ:FTDR)

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

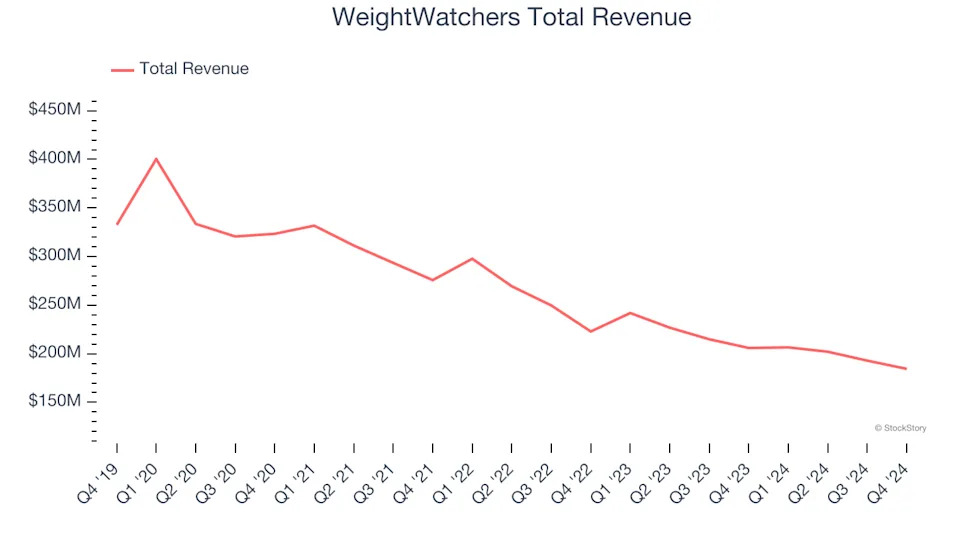

Frontdoor reported revenues of $383 million, up 4.6% year on year. This print exceeded analysts’ expectations by 4.1%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

“2024 was truly an exceptional year for Frontdoor as we delivered record financial results, our operations performed better than ever and we completed the acquisition of 2-10,” said Chairman and Chief Executive Officer Bill Cobb.

Frontdoor scored the highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 33.3% since reporting and currently trades at $38.08.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it’s free .

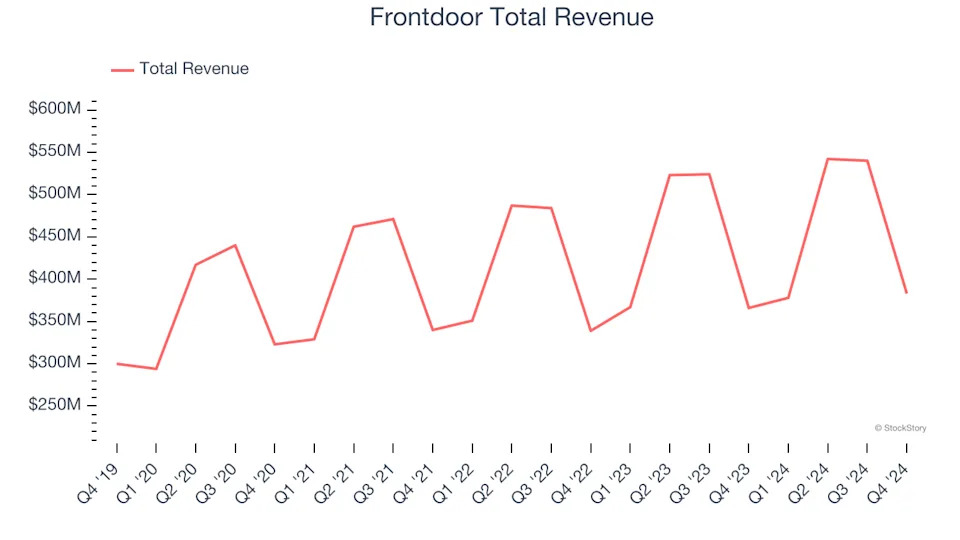

WeightWatchers (NASDAQ:WW)

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $184.4 million, down 10.5% year on year, outperforming analysts’ expectations by 5%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.